|

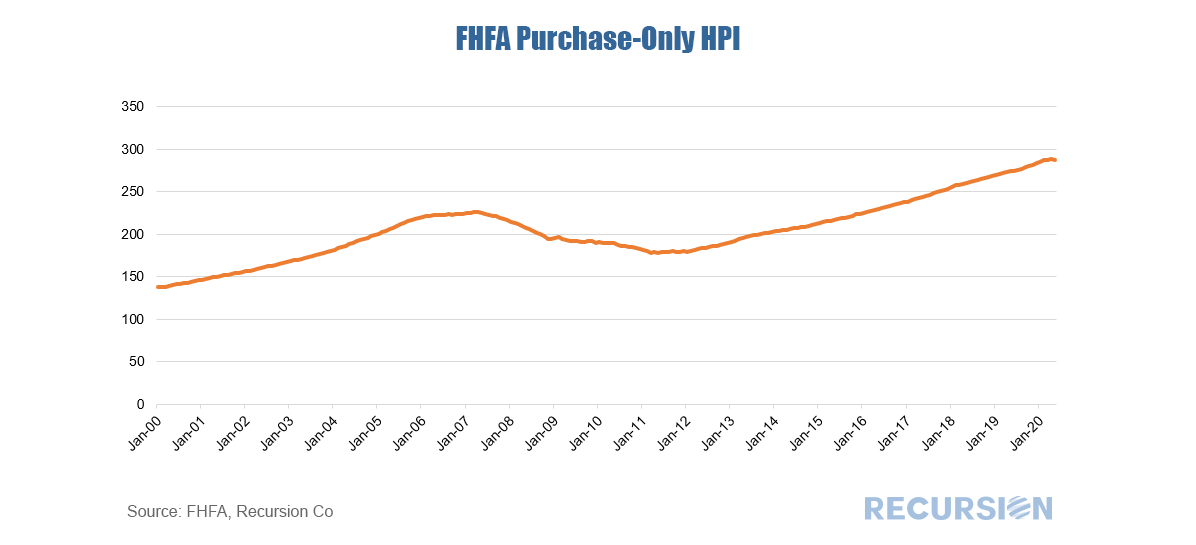

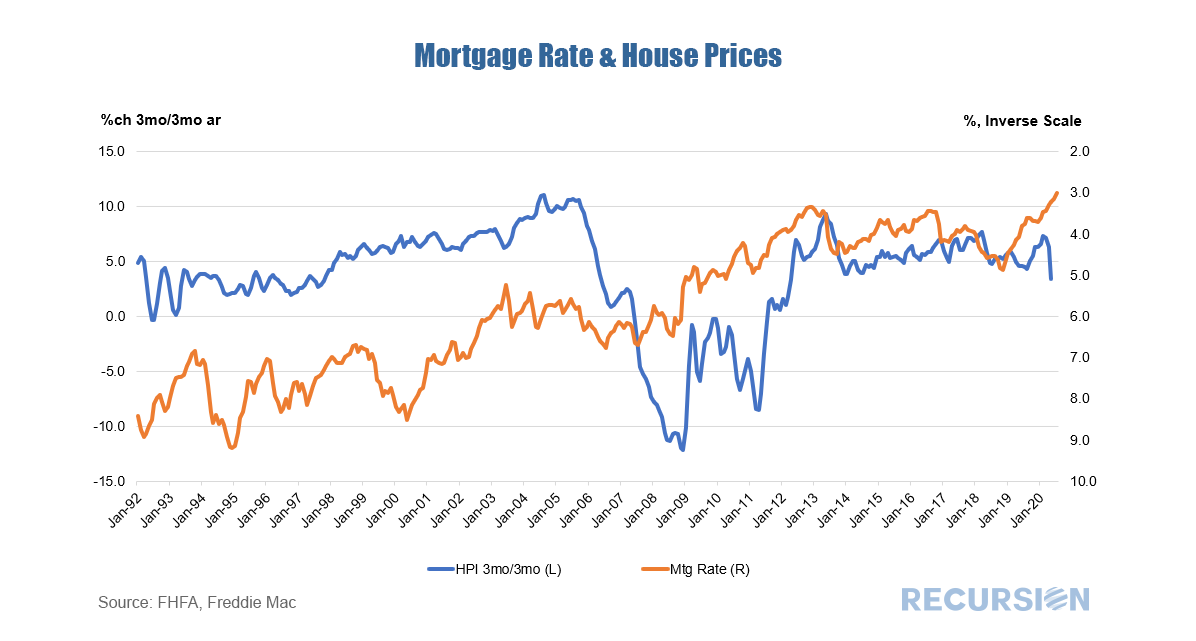

Late last month, FHFA released its purchase-only national house price index for May. This is an index of home prices associated with purchase mortgages that are delivered to the GSEs. The historical pattern is familiar. A notable feature of the chart if you squint is that the index ticked down in May, the first monthly decline since January 2012. There are many differences between the FHFA series and others, but a key distinction is that the FHFA series excludes homes purchased with cash, or with mortgages greater than the conforming loan limits, or with mortgages obtained through the Ginnie Mae programs (largely FHA and VA). House prices are notoriously difficult to analyze. Purchasing a home to occupy is the most important financial decision that most households make in their lives. Many factors play into this decision, including location, affordability, and the prospect for long-term returns. An important factor in many of these considerations is interest rates. All else being equal, lower interest rates make homeownership more affordable, and housing a superior investment compared to other asset classes, notably fixed income. Indeed, historical data below demonstrates that generally interest rates and house prices are inversely correlated. Notable exceptions to this rule are the Global Financial Crisis, and, perhaps, the Covid-19 Crisis. (Please note that the mortgage rate is charted on an inverse scale.) As mortgage rates gravitate lower it’s natural to speculate what policy measures can be applied to prop up the housing market should the need arise. Fundamental changes to behaviors are being unleashed due to the health crisis. As a result, decision makers will need to consider the consequences of the fact that mean reversion will not be part of the new normal.

|

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed