|

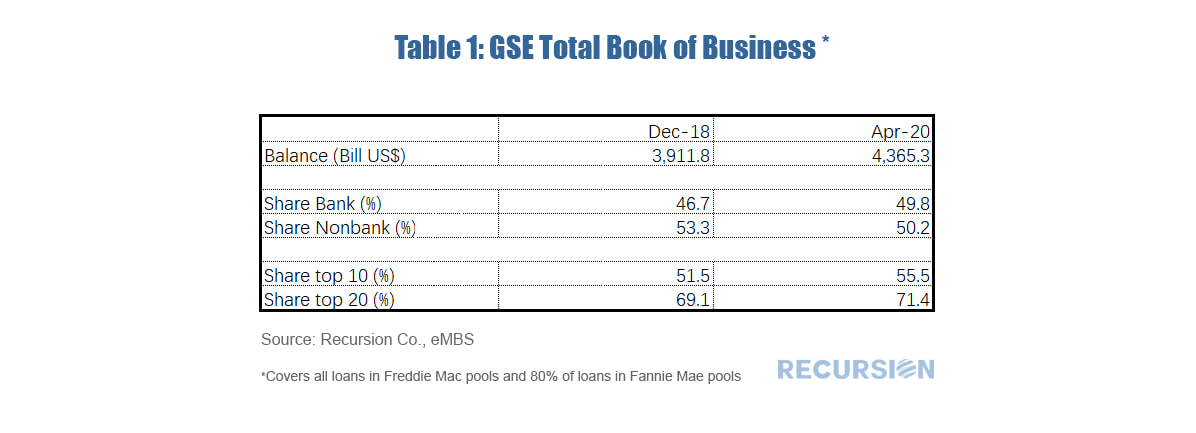

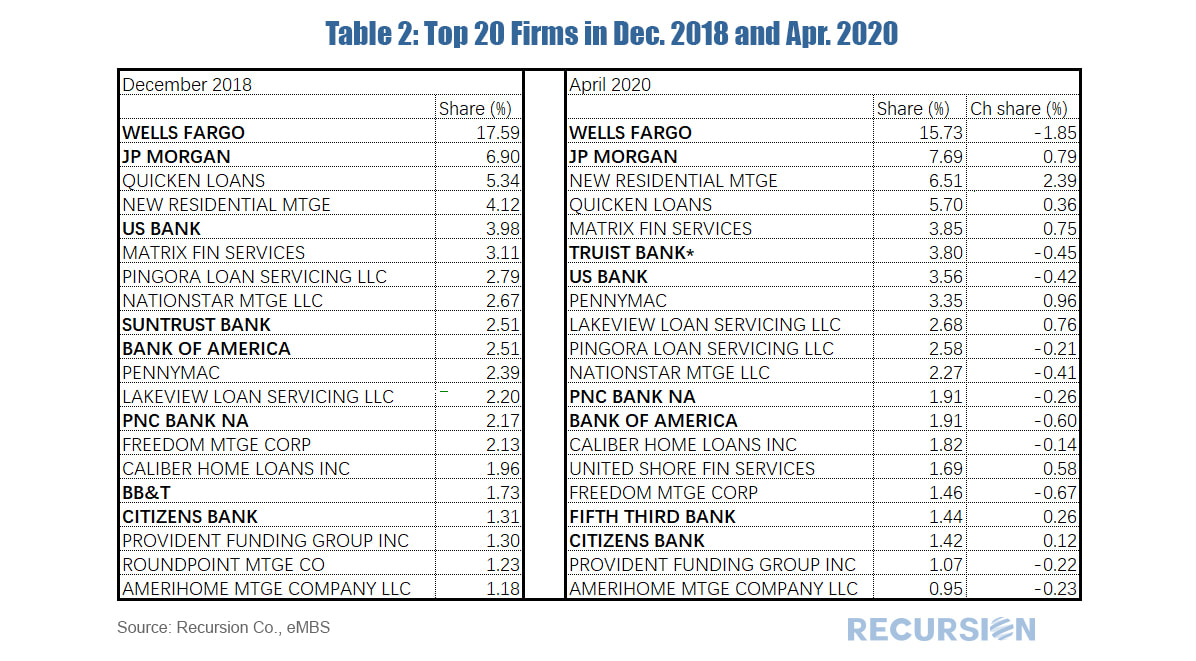

With the CARES (Coronavirus Aid Relief and Economic Security) Act offering forbearance to households with mortgages for up to a year, the onus of payments to mortgage investors falls on the mortgage servicers. Much concern has arisen about the ability of these institutions, particularly thinly capitalized nonbank servicers, to meet these obligations[1]. In the case of Ginnie Mae servicers, the PTAP (Pass-Through Assistance Program) was rolled out to provide a line of credit to servicers in Government programs, notably FHA (Federal Housing Administration) and Veterans Administration (VA). In the case of the GSE’s, no such program has been forthcoming and instead, FHFA (Federal Housing Finance Agency) the regulator of the Government Sponsored Enterprises, Fannie Mae and Freddie Mac, announced that servicers of loans insured by these enterprises is only required to pay investors for the first four months if a loan is in forbearance[2]. Insofar as there may still be concerns about solvency, should delinquencies spike high enough it is natural to ask who these institutions are. At Recursion Co, we have up-to-date information for all the loans in Freddie Mac pools, and about 80% of those in Fannie Mae pools, some 23 million loans. These loans come with a myriad of characteristics, including the names of their servicers. Using advanced digital tools applied to enormous data sets, we are able to identify those firms with the greatest presence in the mortgage servicer market for the GSE’s. To analyze recent trends, we look at the books of business in December 2018 and April 2020. As can be seen, in April 2020 the share of nonbank servicers accounts for nearly half the total, up from 46.7% in December 2018. The servicing market is extremely, and increasingly, concentrated, with the top 10 servicers out of more than 1,700 in our database accounting for over 55% of the market and the top 20 over 71%. Within this top group are a wide variety of institutions utilizing vastly different strategies. Below find a table of the top 20 firms in both December 2018 and April 2020. In each case the market share is presented, and for April 2020 the change in this share is also expressed. Firms in Bold are banks. There are a couple of key takeaways. First, while firms may have changed positions between December 2018 and April 2020, there is strong consistency between the list of names in the top 20 in the two periods. Truist Bank was formed in 2019 as the merger between Suntrust and BB&T. Truist’s market share in April 2020 came in almost 0.5% below the sum of the two predecessor institutions at the end of 2018. The merger allowed Fifth Third to gain entrance to the top 20. (#17 after attaining #21 in the prior period). Second, despite a loss in market share of almost 1.9%, Wells Fargo retains a dominant position in the servicer market for the GSE’s with a market share over twice as large as #2 JP Morgan. (Wells bought $51B MSRs from Seneca Mortgage Services in 2017[3].) The decline in share was more than made up by a jump of almost 2.4% on the part of New Residential Mortgage which moved from #4 to #3, surpassing Quicken Loans to become the second largest servicer for loans in GSE pools. The changes in this table reflect decisions made considering a myriad of factors. The Recursion dataset contains information on mortgage underwriting standards, such as credit scores and DTI’s, pricing in the form of loan rates and geography. A careful assessment of all these factors using digital tools is essential in assessing the strategies of these complex organizations in these uncertain times. [1]https://www.washingtonpost.com/business/2020/03/27/mortgage-relief-coronavirus/

[2]https://www.fhfa.gov/Media/PublicAffairs/Pages/FHFA-Addresses-Servicer-Liquidity-Concerns-Announces-Four-Month-Advance-Obligation-Limit-for-Loans-in-Forbearance.aspx [3]https://www.housingwire.com/articles/41248-wells-fargo-acquires-51-billion-in-msrs- from-seneca-mortgage-investment/ |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed