|

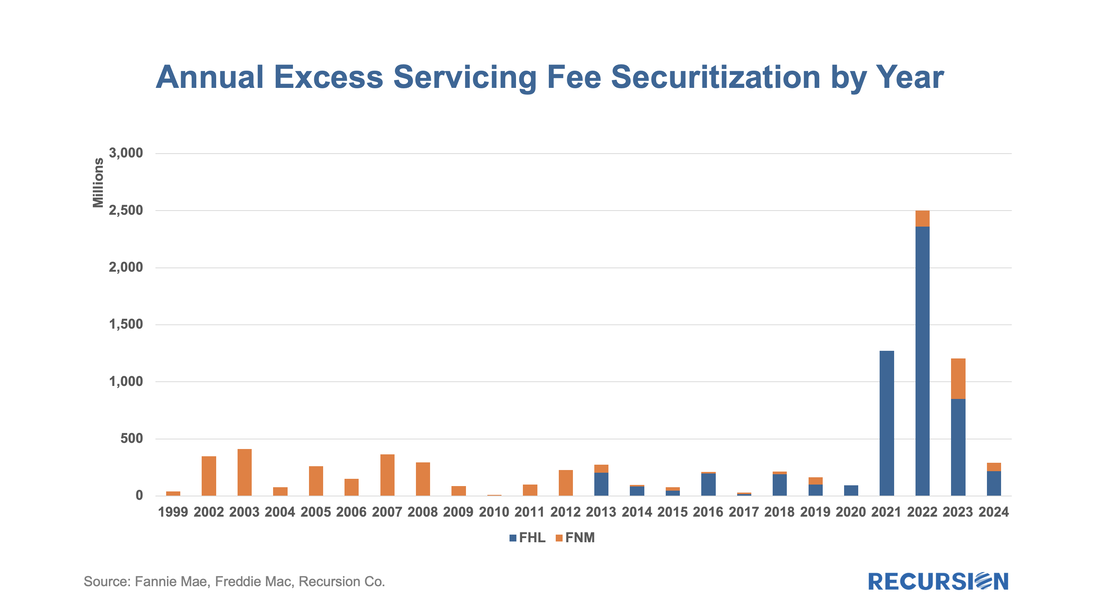

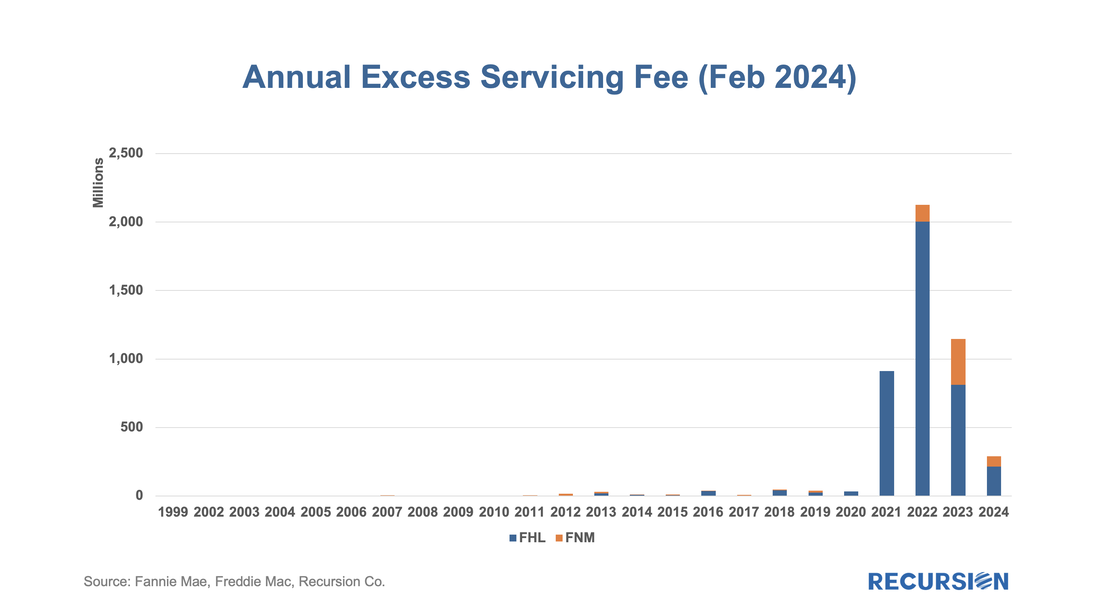

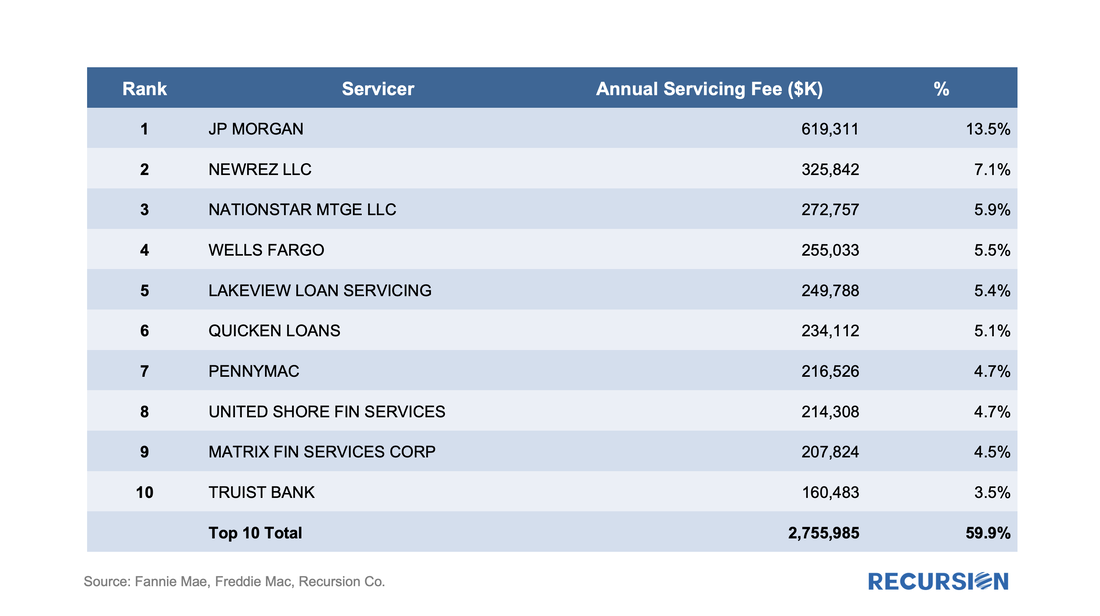

Mortgage Servicing Right (MSR) owners can sell excess servicing fees (ESF) when pricing is supportive or when they need cash. The securitization vehicle for this activity is Agency ESF strips without a Principal-only (PO) component, which are disclosed by Fannie Mae and Freddie Mac. In recent years, issuance of cash strips has been rare, and most strips issued by the GSEs are ESF strips. The following chart shows the amount of ESF securitized each year --- as we can see here Fannie Mae had no activity in such deals in 2020 and 2021 but came back into the market in 2022. To close the gap with Freddie Mac Fannie Mae enhanced its related data disclosures at the beginning of 2023[1]. Fannie Mae’s market position improved from 0% in 2021 to 5.5% in 2022 and to 29.3% in 2023 and 25.8% in the first two months of 2024. The next chart shows the current annualized ESF payment by the outstanding GSE ESF strips. The contributions of the older vintages are small. The fees come mainly from 2021, 2022 and 2023 issuance. The GSE discloses massive data to characterize the distribution and performance of the collateral of ESF strips, including by lender and servicer. Currently, the annual payout amount from ESF bonds is $4.8B. Using the servicer data provided, we calculated and ranked the ESF by servicer, and found that the top 10 servicers contribute 60% of the payment of outstanding ESF bonds: This data has a myriad of applications, notably in tracking the role of ESF strips in balance sheet management on the part of individual firms and monitoring aggregate risk broken down into classes of lenders such as banks and nonbanks. Recursion process all agency disclosure files in an accurate and timely manner. Contract us at [email protected] if you would like to get more detailed information. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed