|

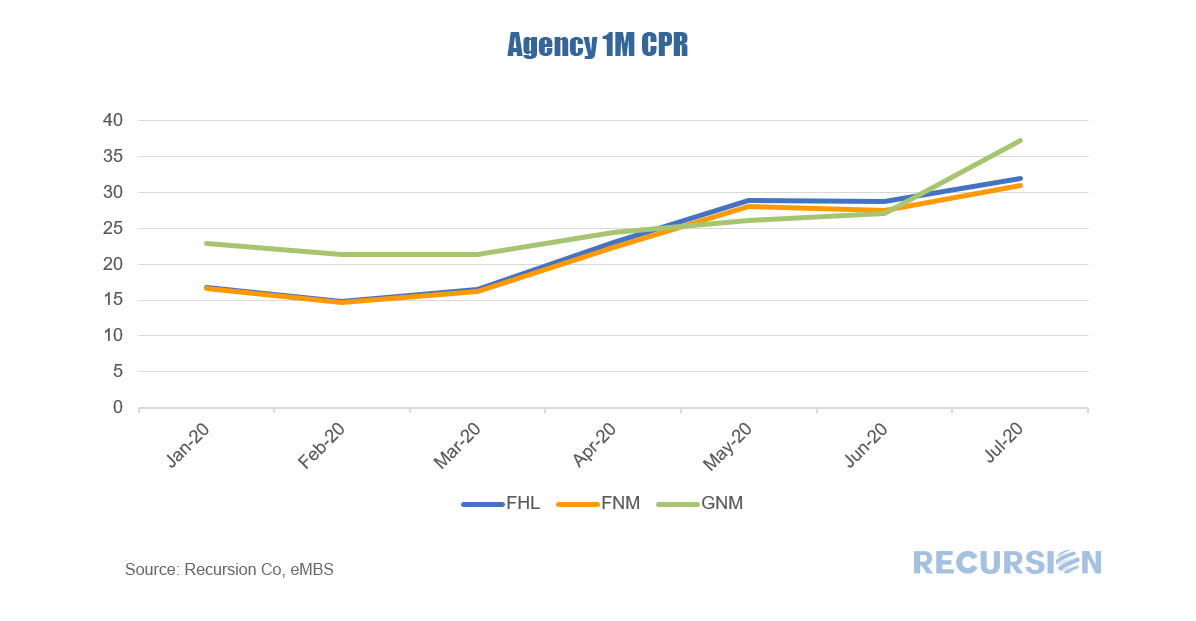

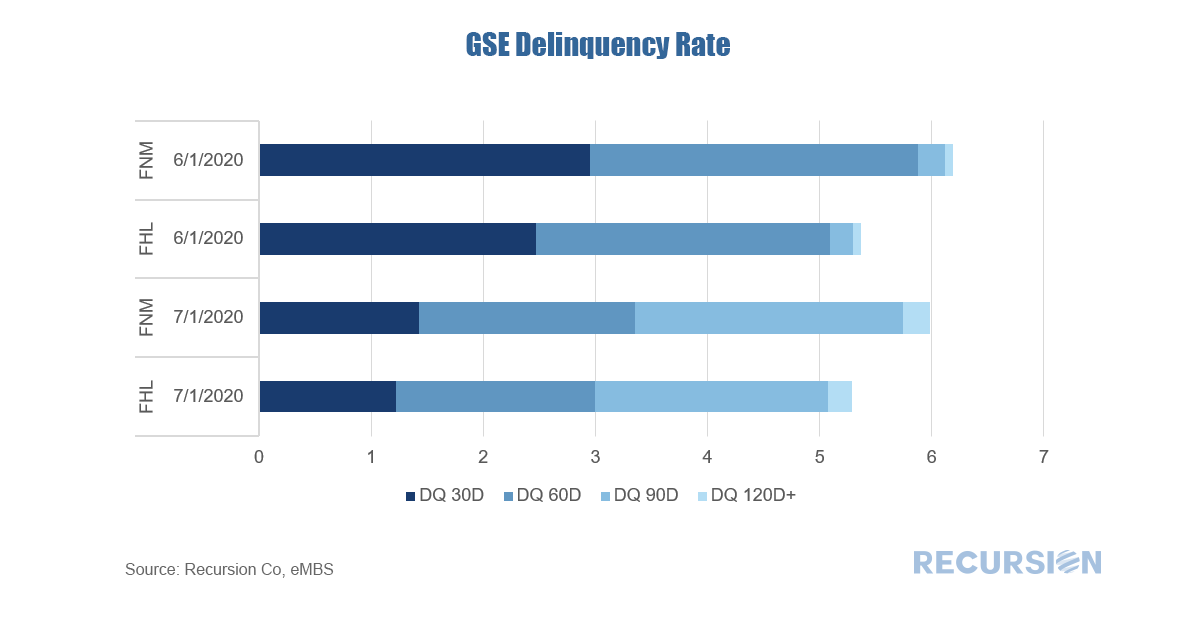

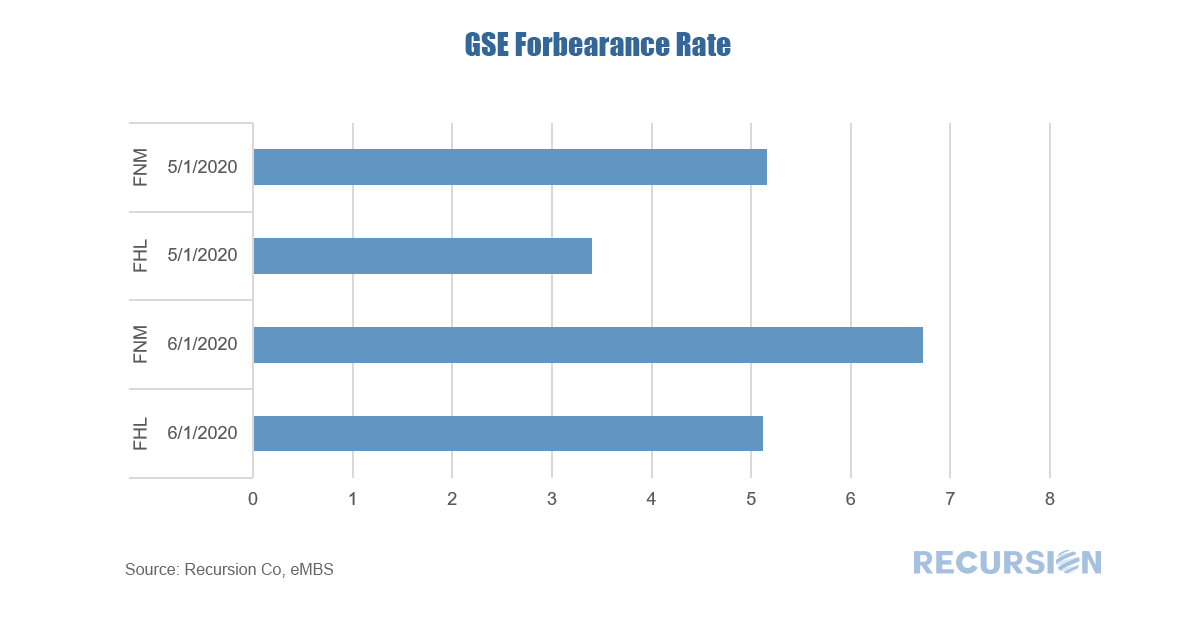

Two data releases Monday night paint a picture of hyper-kinetic refinancing activity and new deterioration in GSE credit performance. First, all three agencies released prepayment data for June showing record refinancings, led by Ginnie Mae programs which skyrocketed by over 10 CPR to 37! This is a much greater increase than experienced by both Fannie Mae (+3.4 to 30.9), and Freddie Mac (+3.2 to 32.0). A significant portion of GNM CPR’s increase could derive from elevated involuntary prepays (CDR), quite possibly driven by the very recent change made to GNM pooling rules regarding reperforming loans[1]. The GSE monthly loan tape also came in, with delinquency data and forbearance data (with a one month lag). These show a pattern of ongoing strains in credit performance. Total delinquencies for Freddie Mac came in at 5.29%, down marginally from 5.37% in previous month. The number for Fannie Mae is 5.98, versus 6.19% of last month. Finally, forbearance data for May showed some increase for both GSE’s with Fannie Mae leading Freddie Mac (6.72% vs 5.12%, respectively) but the gap was little changed from the prior month (5.16% vs 3.41%). As noted previously, the Freddie Mac forbearance data do not include loans in forbearance that are current[2]. Wednesday night we will get loan-level performance data for the Ginnie Mae programs which will offer a useful contrast to the GSE performance statistics. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed