|

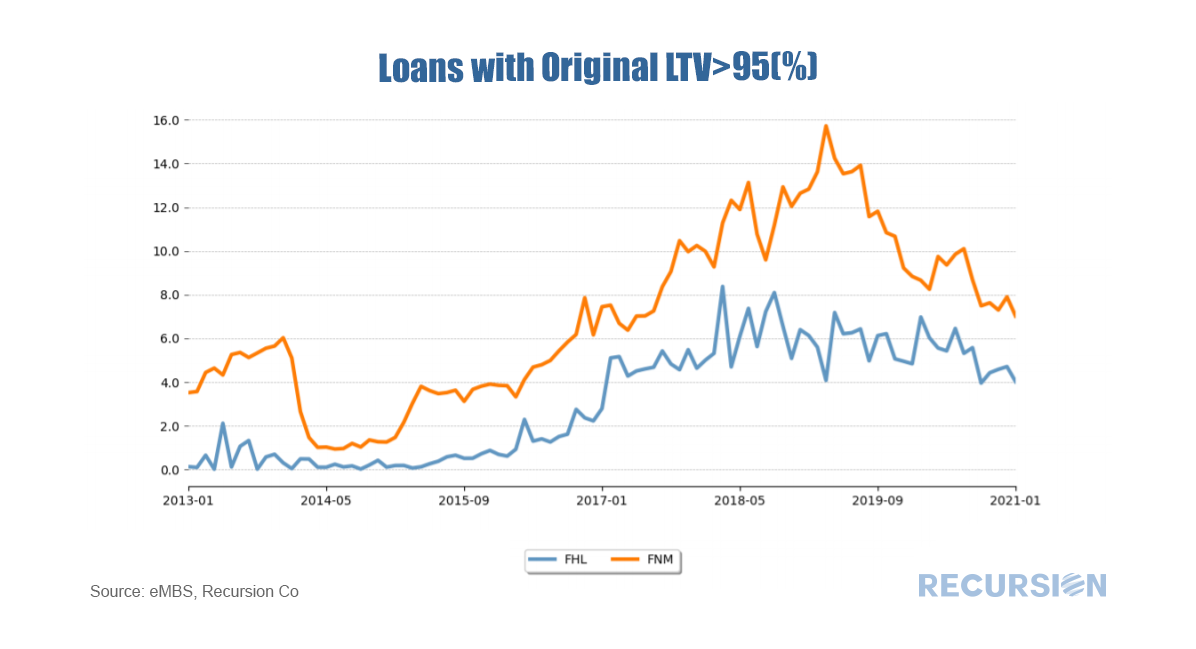

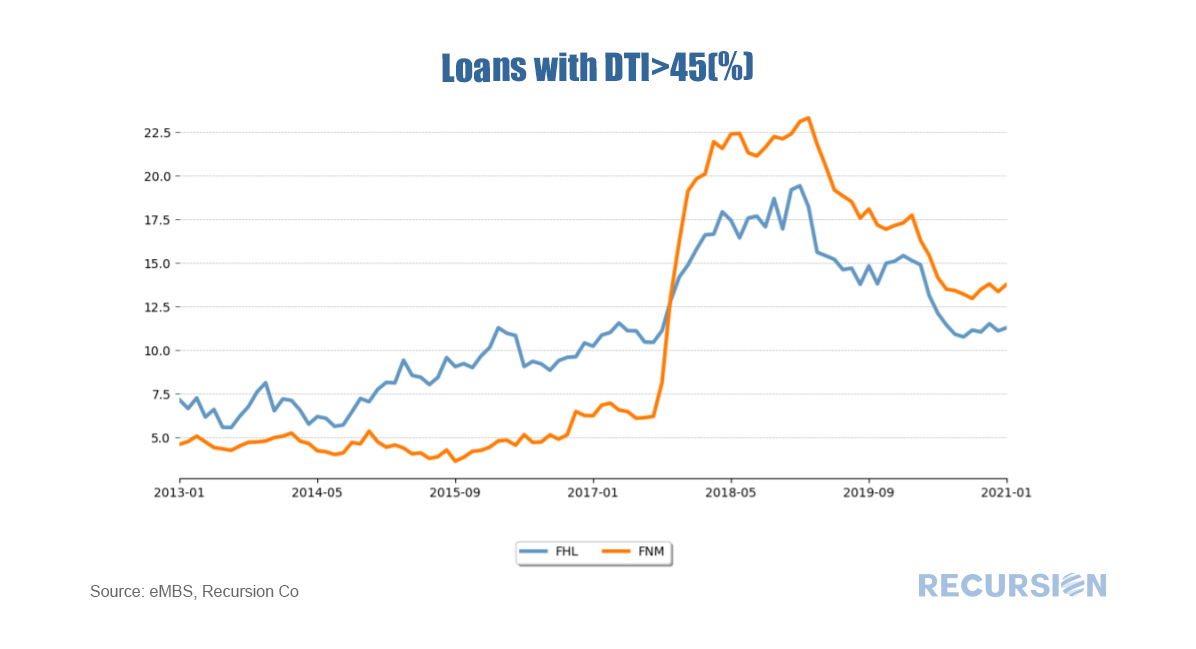

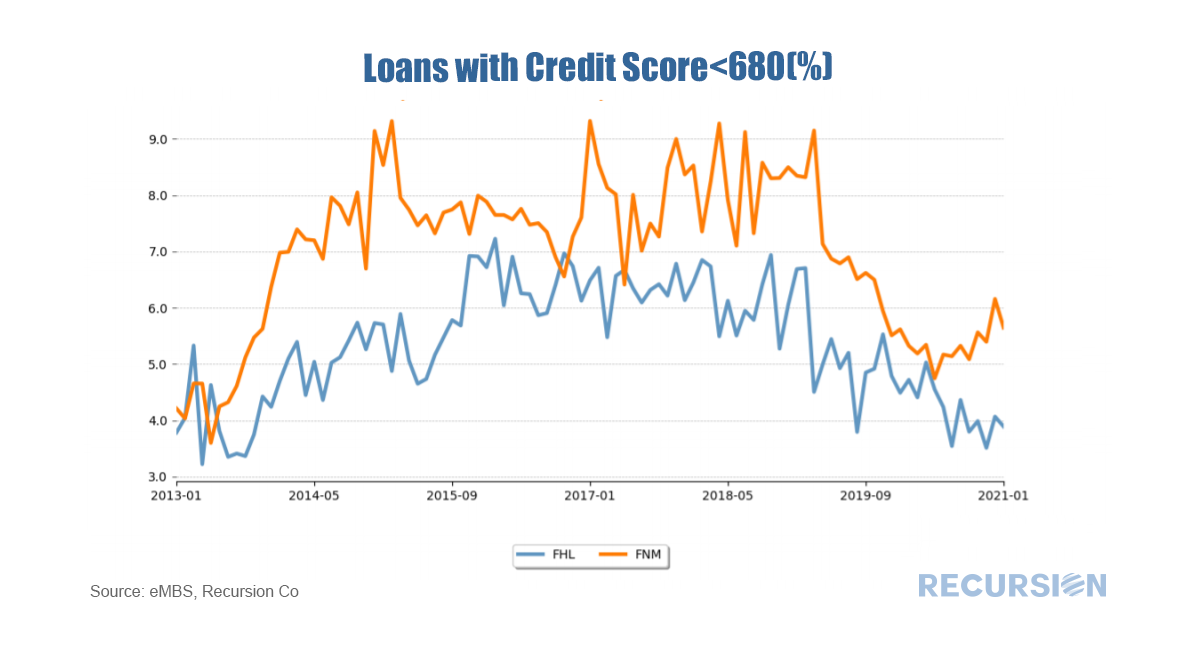

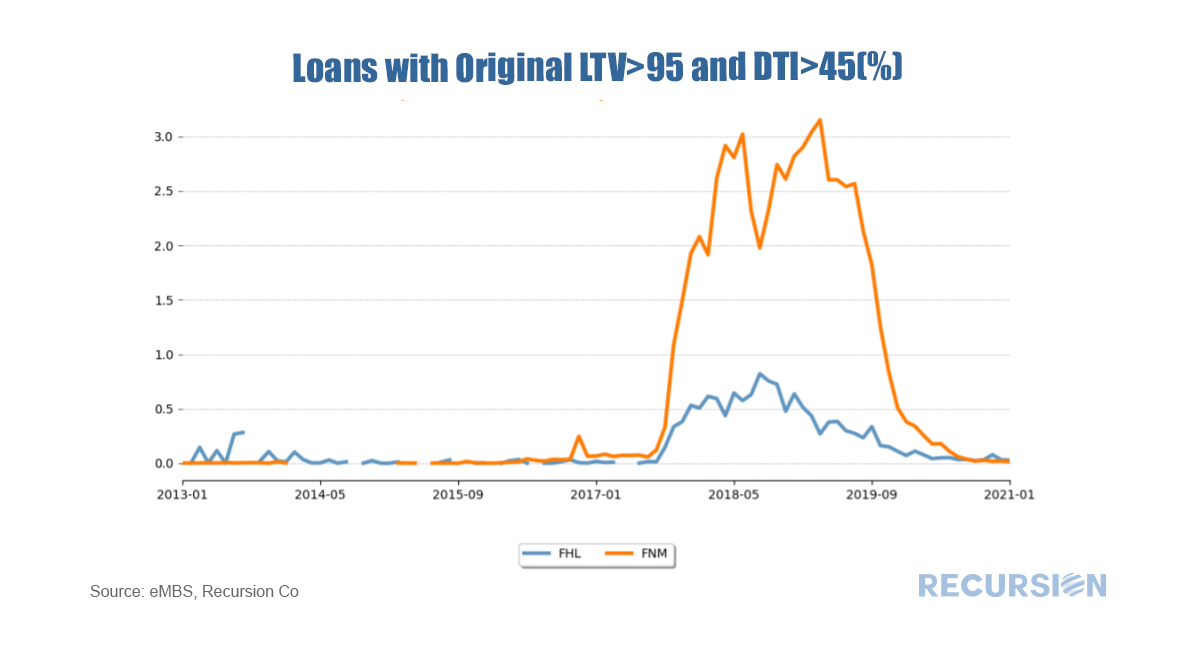

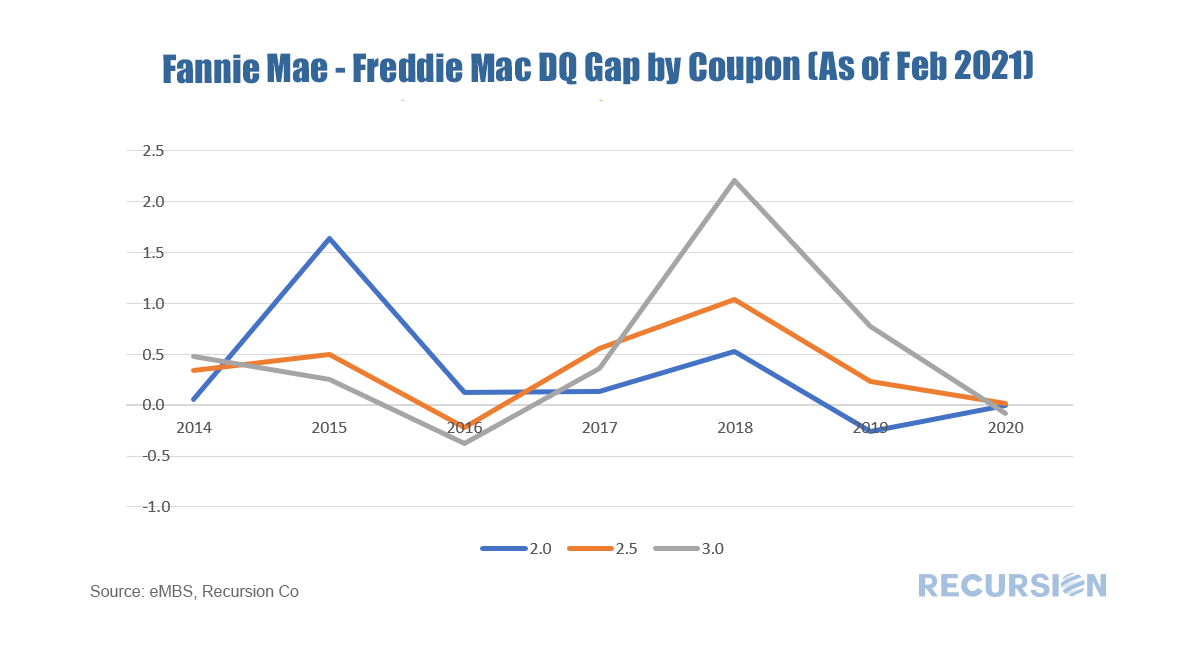

Our last post demonstrated that Fannie Mae performance at the pool level has been lagging that of Freddie Mac since the start of the pandemic[1]. The question remains as to why. The challenge in answering this question is that unlike the case for Ginnie Mae programs, Fannie Mae and Freddie Mac have not been releasing performance data on the loan level[2]. Those who subscribe to our monthly risk reports know that we have been tracking relative underwriting standards between the two mortgage giants for some time. We do this not by looking at the average levels of underwriting characteristics, but rather at looking at the tails of these characteristics. Our experience is that this is a far superior method for this as distinct policy about risk come in much clearer this way. We focus on the share of GSE deliveries with LTV>95, DTI>45, and credit score<680. Casual observation shows that since 2018, Fannie Mae has had a greater percentage of highly leveraged, low credit-score loans delivered to them than has Freddie Mac, with a clear peak of this difference in 2018, and early 2019. This raises a suggestion for investigating the source of the delinquency difference between the two Enterprises. We do not have loan-level data, but we do have pool level data, so we can investigate DQ differences by vintage. The chart below this shows the difference in total delinquency rates by vintage for the 2.0%, 2.5% and 3% coupons. The clear spike in the gap in 2018 is strong prima facie evidence that relative underwriting standards are at the center of the performance difference. [1] https://www.recursionco.com/blog/fannie-mae-february-pool-level-performance-falls-vs-freddie-mac

[2] The GSEs will begin to provide such data beginning next month. See http://www.freddiemac.com/research/datasets/sf_loanlevel_dataset.page |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed