|

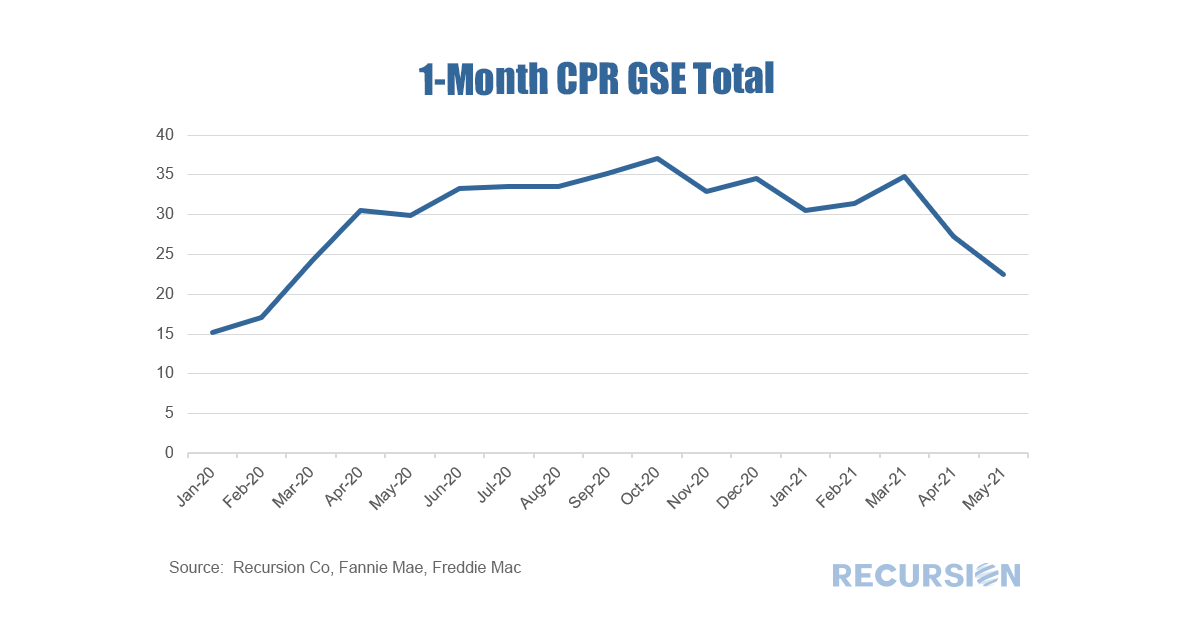

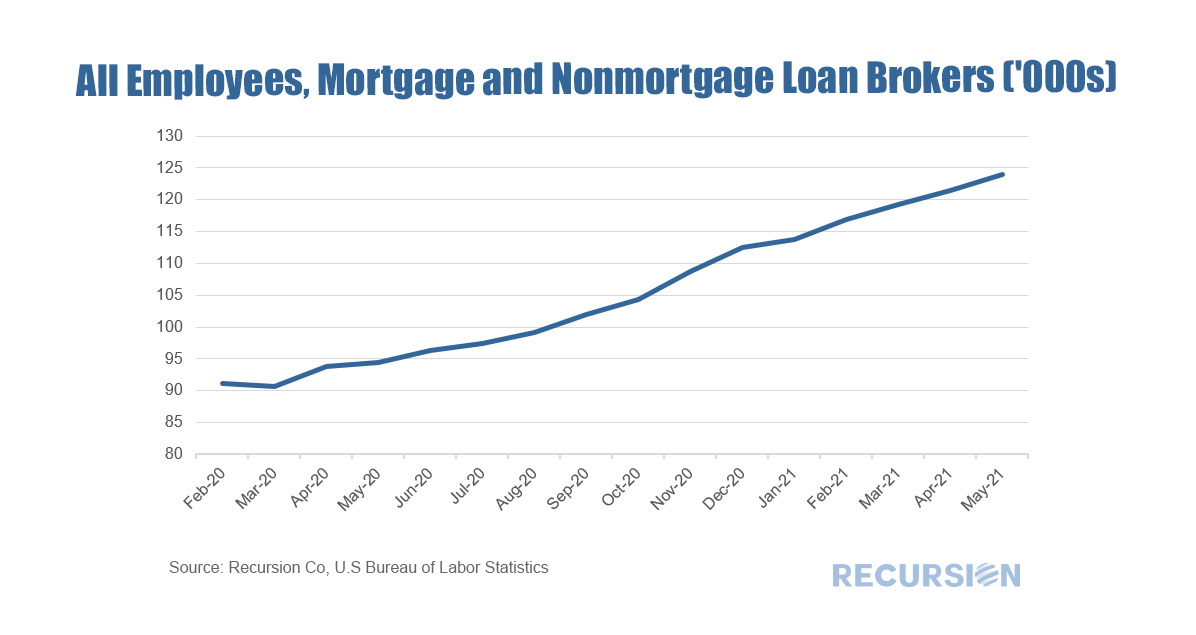

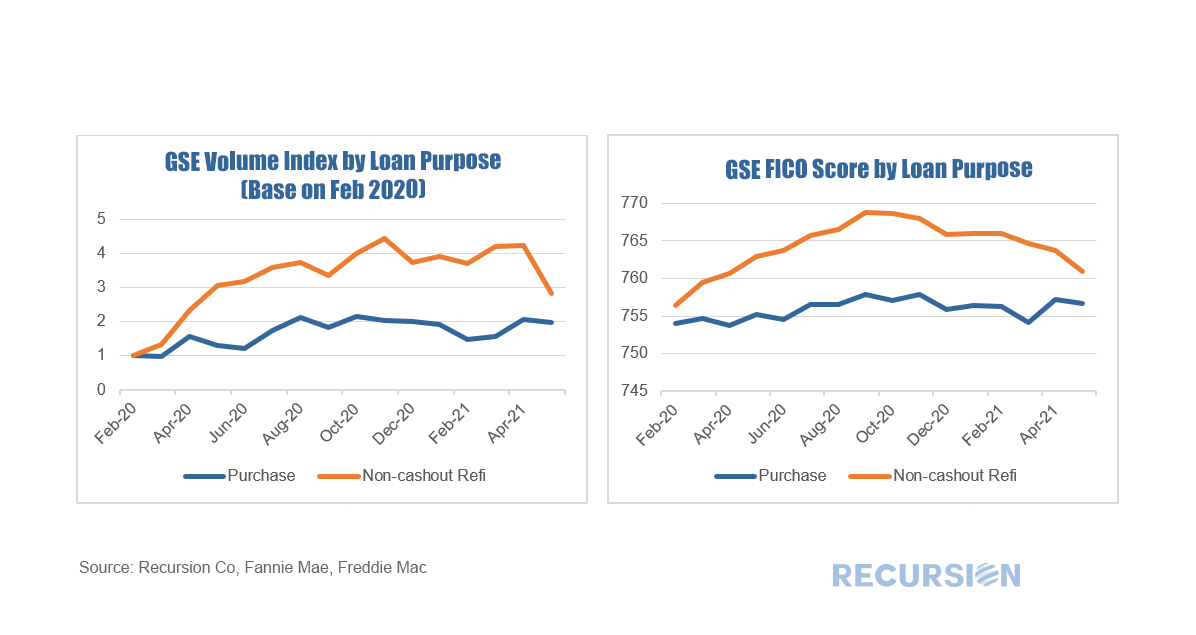

We received the monthly GSE data download for the June book of business over the weekend and prepayment speeds dropped for the second consecutive month, with the 1-month CPR printed 22.4, the low posted since 17.1% was reached in February 2020 just before the onset of the pandemic. Mortgage rates are of course the key driver here, but other issues matter as well, notably lending capacity. With the onset of the pandemic and the associated loosening of monetary policy and spike in demand for housing away from dense locations, the mortgage industry became overwhelmed. Originators were busy hiring and increased their capacity over the past 18 month to deal with the long period of refinancing activity. However, as prepayment speeds slow down, it appears that the capacity building may be overshooting. In response, originators have started to lower their underwriting standards to create enough volume to fully utilize the capacity. Traditionally, the industry fine-tunes its production through tweaking its credit standards to keep its pipeline as full as possible. This is occurring now notably for refinance mortgages: What we can see is that purchase demand remains strong, with the swing product being refinance mortgages. It is evident that lenders are trying to smooth out refinance production with countercyclical credit tightening and loosening. As credit scores are higher than was the case in the pre-pandemic period there is room to ease further, but the ultimate extent is highly uncertain.

|

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed