|

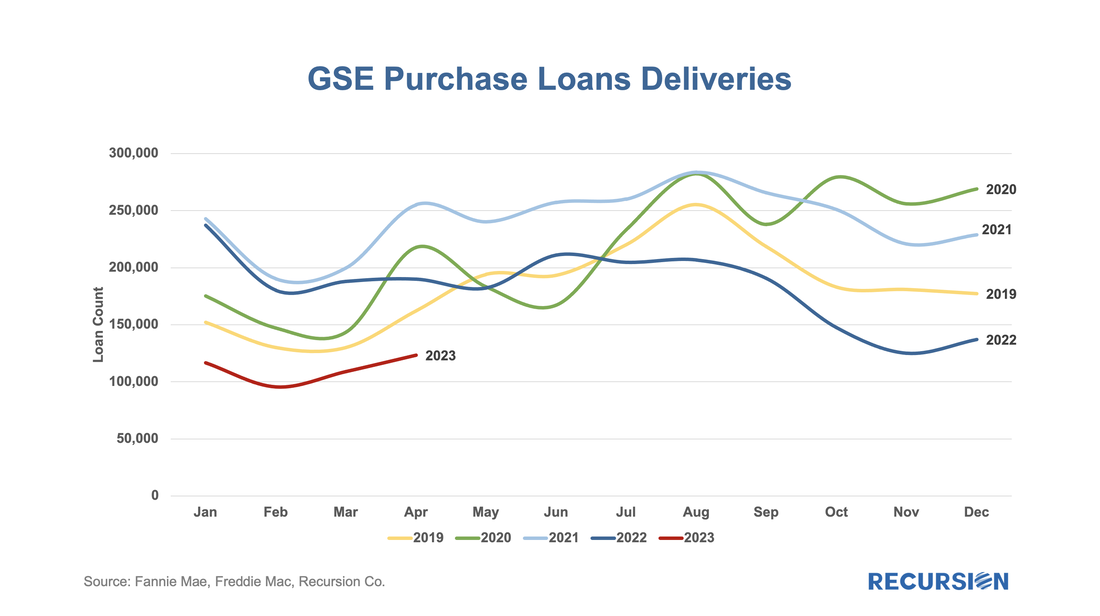

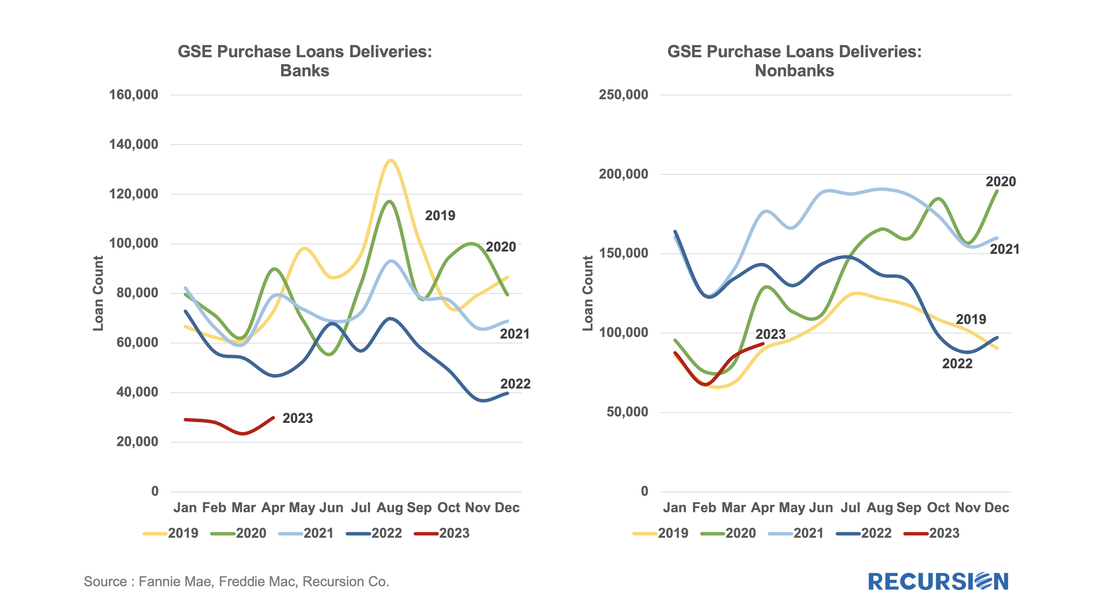

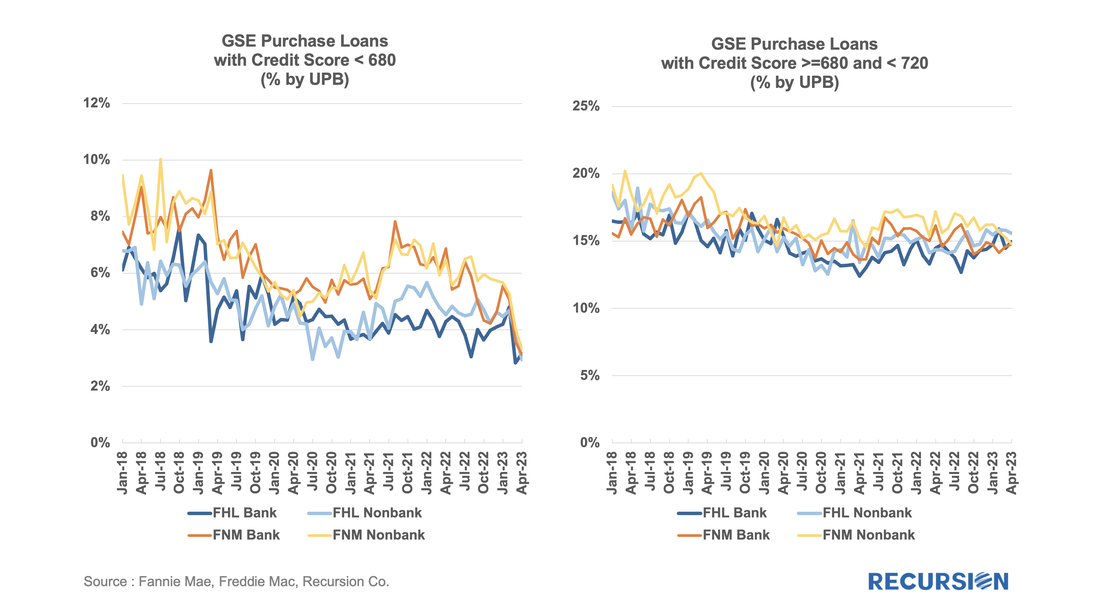

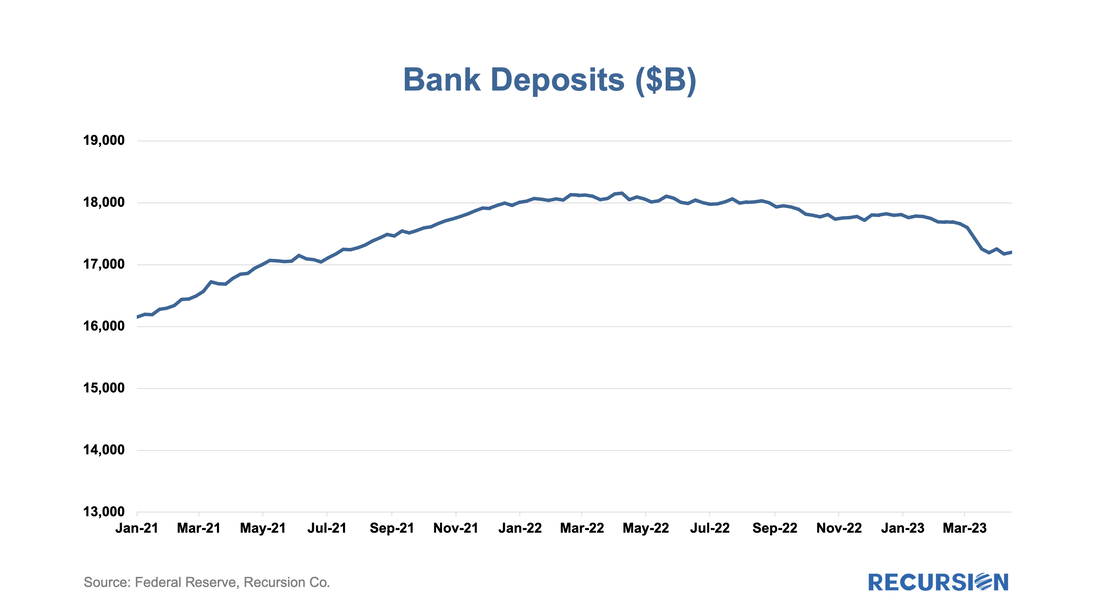

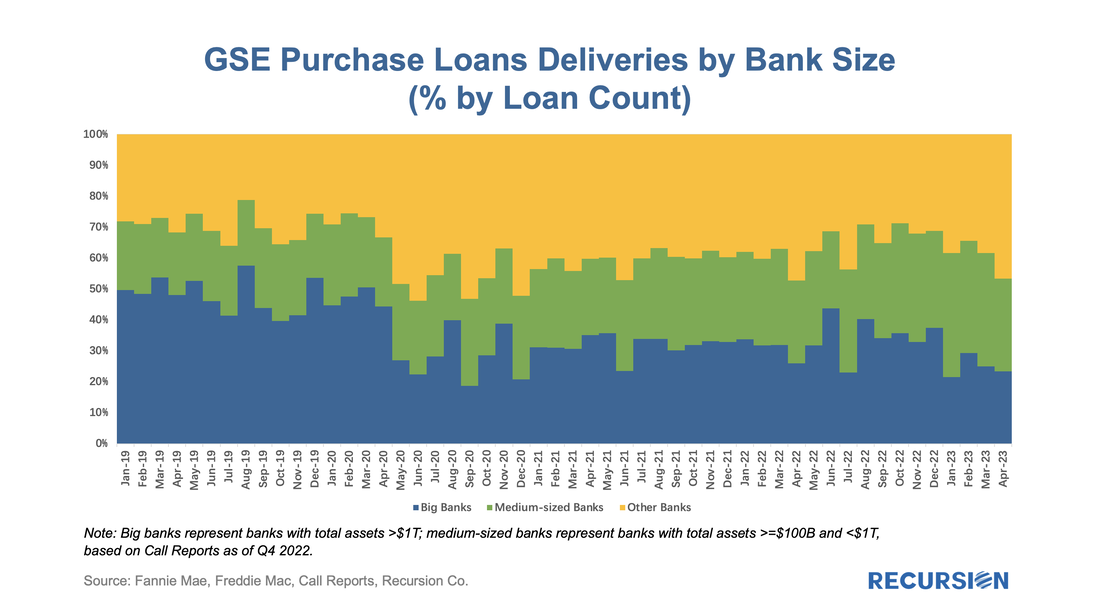

As daily April Agency mortgage loan delivery data completed, we found convincing evidence that the freeze in market activities we have witnessed since the fourth quarter of 2022 is continuing, although there are some new twists. Here is the chart for the loan counts of purchase market deliveries to the GSEs back to 2019. Rather than do this as a time series, we stack the years over an annual monthly x-axis to better correct for the seasonality in the time series: There is a wealth of information here, but caution needs to be used in the interpretation as deliveries can reflect factors other than originations, such as occurred in 2020 when banks swapped loans on their books for MBS in the wake of the onset of the Covid-19 Pandemic. The advantage of this approach is that we have a wealth of information on these loans that cannot be seen from home sales data. With all this in mind, the 2023 spring surge can best be described as “anemic”. The main nuance, however, can be seen by breaking this data down by servicer type: The tepid nature of the recovery this year is far more notable for banks than nonbanks. Reading the headlines, it is difficult to avoid the conclusion that the current turmoil in the banking system has something to do with this. Confirmation can be gained by looking at the same charts for FHA loans, which show a similar pattern: So far, it doesn’t appear that this lukewarm recovery is associated with concerns about credit risks associated with a cyclical downturn, as credit appears to be broadly available except perhaps at the extremely lower tails of the distribution leading to aversion to providing credit to low-income borrowers. There seems to be a modest pullback in credit to the extreme tails of the credit score distribution: Instead, the practical driver of weak recovery seems to be associated with the withdrawal of deposits from banks, spurred naturally both by the higher returns available from other short-term instruments like CDs and Money Market Funds, but recently accelerated by the spectacular failure of three medium-sized banks. The bank turmoil has captured the attention of depositors with balances over the $250,000 FDIC insurance limit, especially those with accounts at banks deemed not to be “too big to fail”. While medium-sized banks may be feeling the brunt of these withdrawals, large banks that are receiving these funds are, in many cases, lowering their duration estimates of these new liabilities, unsure where the funds will eventually settle. It appears that banks have little incentive to deploy these funds into long-term lending vehicles such as mortgages. Longer term, there is a great deal of uncertainty about the regulatory response will be to the present turmoil. But the market focus is very much on the middle tier of banks with assets between $0.1 and $1.0 trillion dollars. An interesting takeaway here is that the 7% decline in the share of medium-size banks to 30% in conforming purchase mortgage deliveries in April was not taken up by the big banks (which dipped by 2% to 23%), but rather by a 9% surge in the small bank share to 47%. This data is noisy, but observing the trends in market share by category of bank lenders will offer insights into both the availability and price of credit in the mortgage market in coming years.

|

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed