|

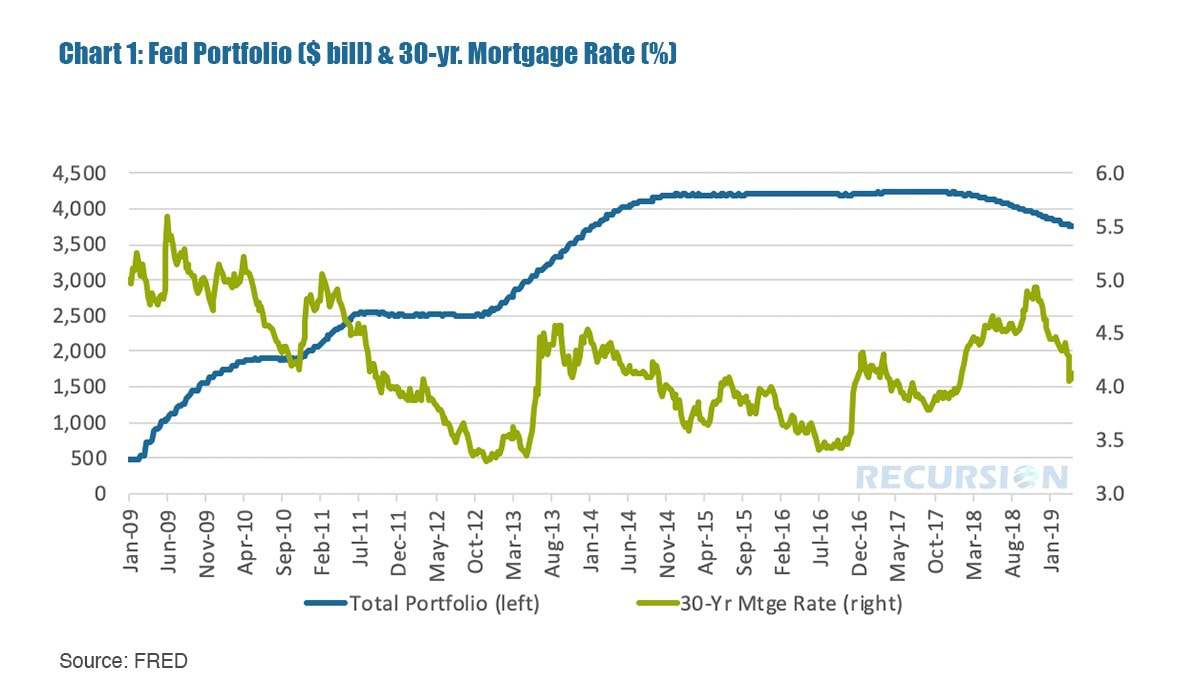

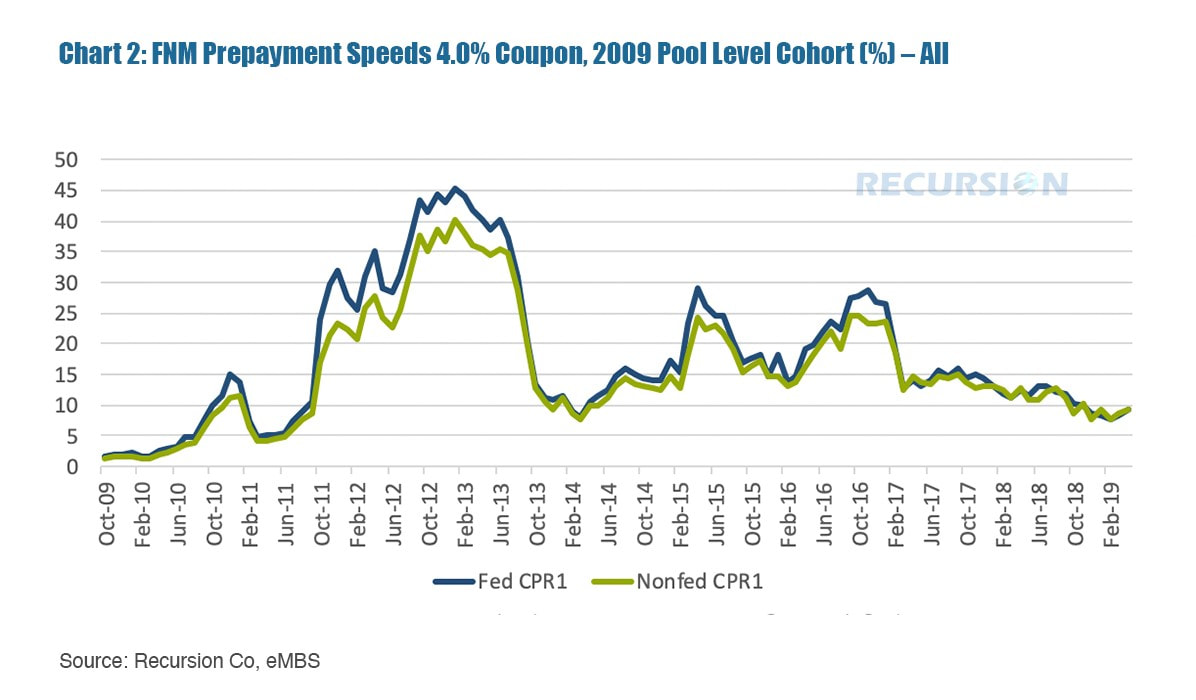

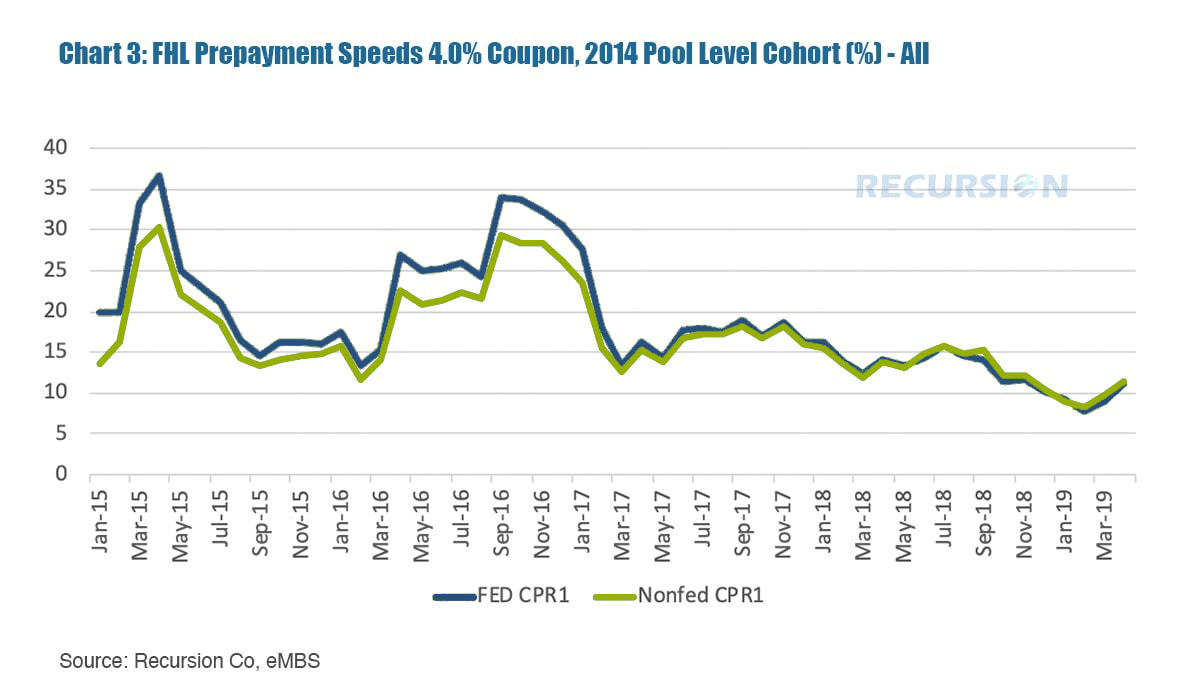

In the wake of the economic dislocation that occurred with the onset of the Global Financial Crisis, (GFC), central banks responded with a variety of policy innovations, including Large-Scale Asset Purchases (LSAP’s), also known as Quantitative Easing (QE). Different central banks have implemented these programs in distinct ways, but the Federal Reserve purchased massive amounts of Treasuries and mortgage-backed securities (MBS) to place downward pressure on long-term interest rates[1]. (Chart 1) There is a great deal of discussion about the effectiveness of these purchases, but there is a broad consensus that the LSAP program had the impact of lowering long-term interest rates, notably mortgage rates[2]. By purchasing MBS, the Fed was not only working to lower rates, but to stimulate the economy directly by encouraging consumers to refinance their mortgages, which would release income for other spending or savings. Assessing the magnitude of the impact here is particularly challenging given the complicated structure of mortgage-backed securities (MBS). One way to look at this policy effect is through an examination of the prepayment speeds of the securities the Fed owns compared to the rest of the market. To make this comparison, we chose two particular cohorts, Fannie Mae 4% coupon mortgages issued in 2009, and Freddie Mac 4% coupon mortgages issued in 2014. As can be seen, in both cases the Fed portfolio prepays faster than other mortgages during periods of low long-term interest rates. As such, the impact of the impact on the prepayment channel is greater than that implied by the share of their holdings of these securities. Such a conclusion can only be drawn through the application of the new digital tools to assess novel innovative approaches to monetary policy. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed