|

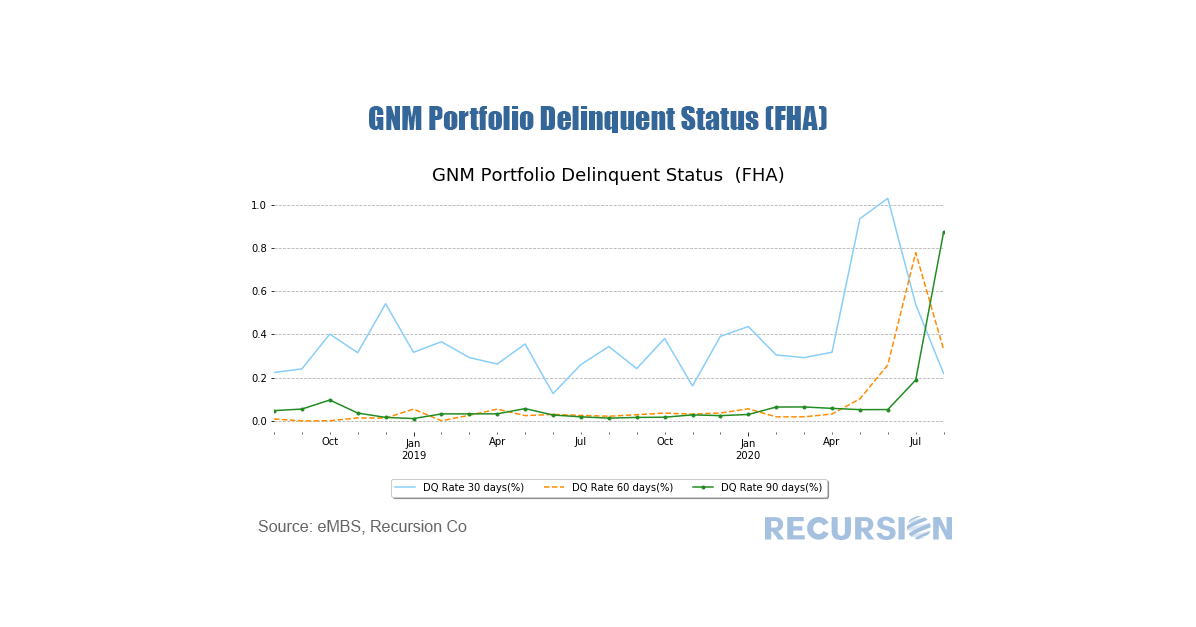

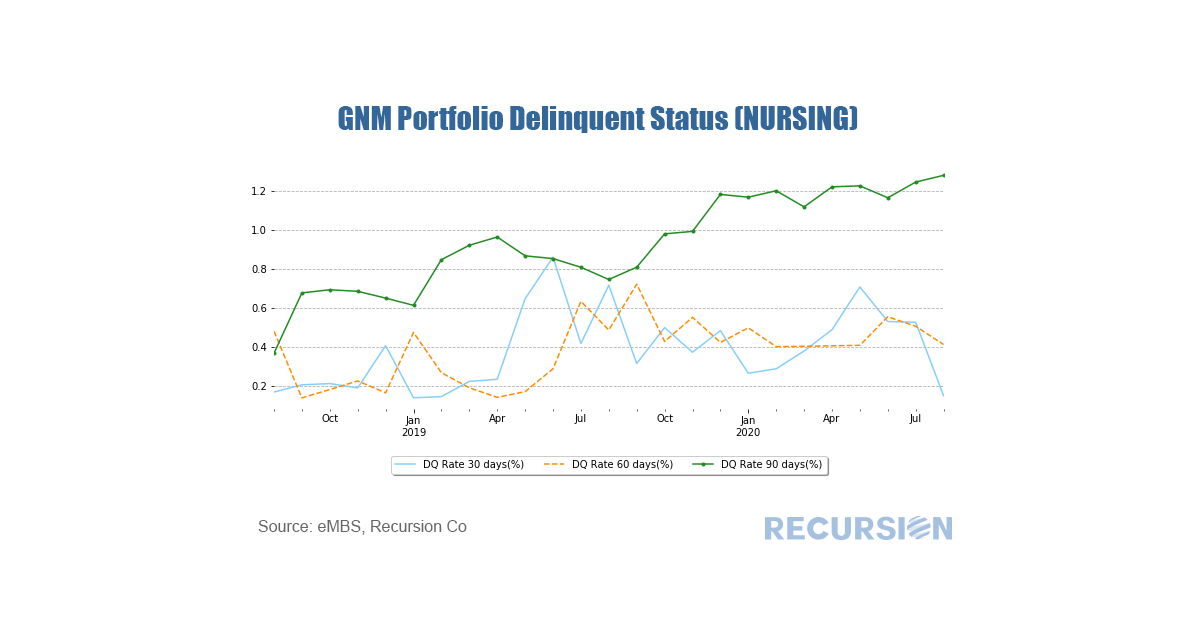

As is the case for residential mortgages, every month Ginnie Mae publishes data on loan-level delinquencies for its commercial real estate programs. The structure is a bit different than for single family, with different categories (the dominant one being FHA multifamily, but also hospitals and nursing homes). In this short post we look at recent performance for FHA multifamily and nursing homes. Traditionally, multifamily DQs for FHA are low because these loans are concentrated in affordable housing, where there is a persistent condition of excess demand. The costs of eviction are low and new tenants are ready to move in. But this is not necessarily the case in the COVID-19 era as the economic impact falls most heavily on the lower income working class, so there are fewer people who can afford affordable housing without support from government income programs such as jobless benefits. *The underlying data and reports are available upon request The pattern here looks rather like that seen in residential mortgages: short-term DQs rising at the onset of the crisis from April to June, and then falling back as employment recovered. However, longer-dated delinquencies remain elevated as many workers find that they will not be recalled to the jobs they had before the crisis. The path forward depends on the path the virus takes, and the policy response. An interesting distinction can be seen in the category of nursing homes. *The underlying data and reports are available upon reques The fundamentals of the nursing home sector are not as strong as those of apartments, with comparatively high 30-day DQs over time. However, rising longer-term missed payments appears to be a part of the landscape over the past two years. Here the issues seem to be more structural than cyclical. Watching this trend progress in coming months will provide a useful perspective on the broader landscape of the new normal.

|

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed