|

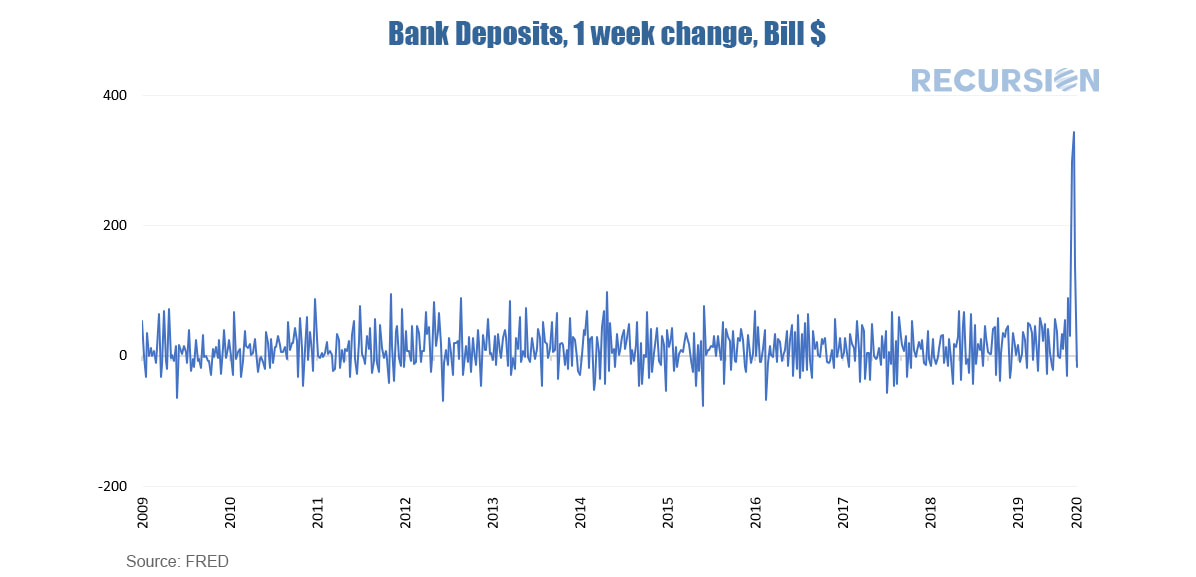

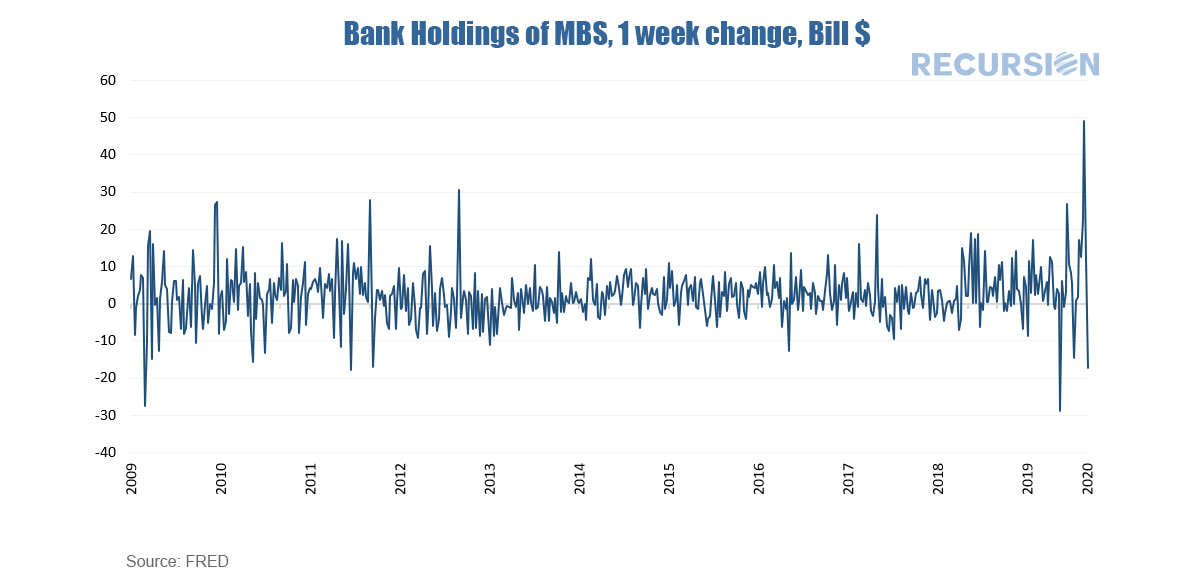

Overview With the onset of the Covid-19 crisis, the role of the banking sector has once again risen to the forefront of concern. As noted in an earlier post[1] the sharp spike in unemployment is certain to lead to a surge in delinquencies. Substantial purchases by the Federal Reserve of Mortgage Backed Securities (MBS) have had a limited impact on rates facing borrowers[2] due in part to uncertainty around the magnitude of the losses and who will bear the costs. Policies regarding forbearance and liquidity provision to mortgage servicers are having an impact on lending standards and the availability of credit. Banks play a significant role in the mortgage pipeline as originator, servicer and investor. Most of the current focus is on the first two, but the importance of their role as investor is also crucial. According to Home Mortgage Disclosure Act (HMDA) data Recursion uploaded to the cloud, 3.1 million individual single family loans with a balance of $739.4 billion were originated in 2018 by the banks, of which 60.4% were held on their balance sheet. Each loan file in the data set contains many characteristics, including originator information. As banks originated about 43% of all mortgages that year, the implication is that about one quarter or all residential mortgage production was kept by the banks. Beyond that, banks are significant purchasers of agency MBS. According to Federal Reserve data, in Q4 2019 banks held about 25% of the $9.6 trillion agency MBS market[3]. Banks like mortgages as an investment, spurred by solid fundamentals related to firm labor markets and rising, but not overly stretched home prices. Banks are protected from credit and default risk by owning agency MBS instead of mortgage whole loans and enjoy favorable treatment from the capital rules set by the regulators. The Covid-19 Impact Suddenly, much has changed. The surge in unemployment has been unprecedented and has been accompanied by severe financial dislocation. This can be seen in developments in the banks’ balance sheets. Weekly data on these is published by the Federal Reserve and the data are striking: As can be seen, the market dislocation led to an unprecedented surge in bank deposits as investors sold risky assets and placed the proceeds in banks. Some of that ended up invested in agency MBS. In the next post we will look at the holdings of MBS on the part of the largest banks. |

Archives

February 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed