|

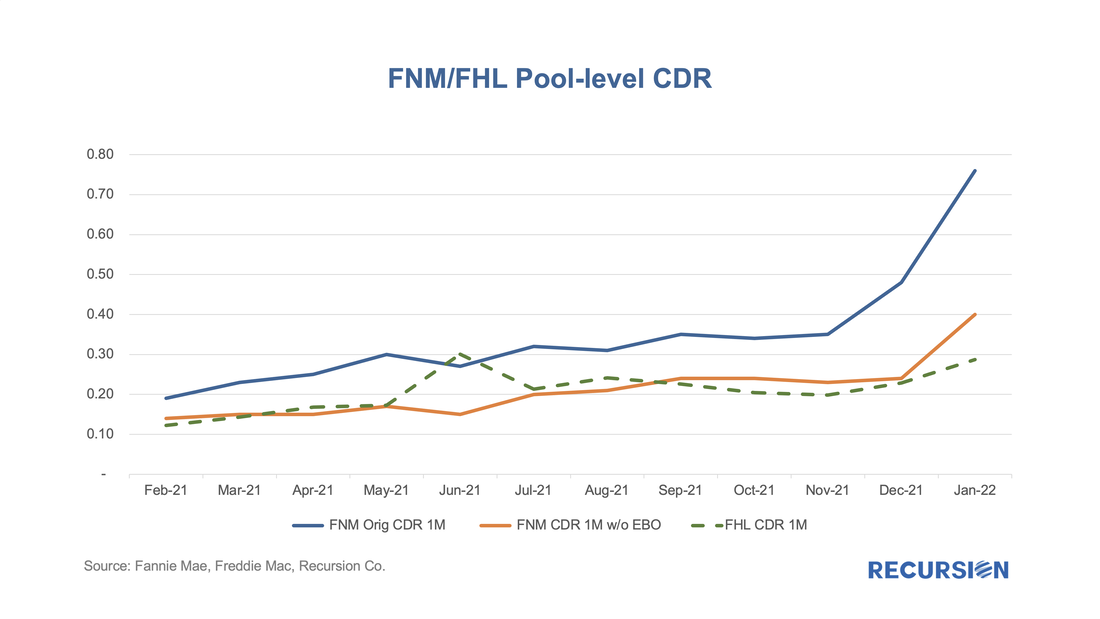

In an earlier post, we discussed the use of trial modifications as a leading indicator of buyouts, as loans in these programs must experience three months of successful payments prior to being eligible for a permanent mod[1]. On January 25, Fannie Mae announced that they had purchased certain loans out of pools prior to the completion of the necessary trial payments.[2] Then, on March 25, Fannie published a list of these securities, allowing us to quantify the impact of this event on the performance of their pools[3]. The spreadsheet attached to the March announcement contains over 17,800 entries dating back to February 2021 and states that the total unpaid balance bought out early amounted to over $4.5 billion. The point of this post is to assess the magnitude of this activity on Fannie Mae’s prepayment speeds. To address this question, we imported the data in the file released by Fannie Mae into our Recursion Pool Analyzer. As a first step, we look at the impact of these purchases on CDR’s as the activity was clearly involuntary. The impact on CDR’s of the early buyouts was clearly material, with the maximum impact felt in January this year when the activity resulted in an unintended boost in involuntary prepays of 0.36 to 0.76. If those loans were not bought out in that month, they will either be bought out later or prepay at a much later date. Fannie Mae provided its estimate of the “Financial Impact” of these early buyouts, generally equivalent to 1-3 months of P&I of the loans. However, there are some with more than 3 months of impact. The early buyout changes the timing and distribution of CDR. Calculating this is a daunting task since there are many reasons why a loan might be bought out of a pool. In a supporting reference document, Fannie Mae provides a taxonomy of possibilities in calculating the financial impact of the EBO’s[4]. There are four categories presented. These are:

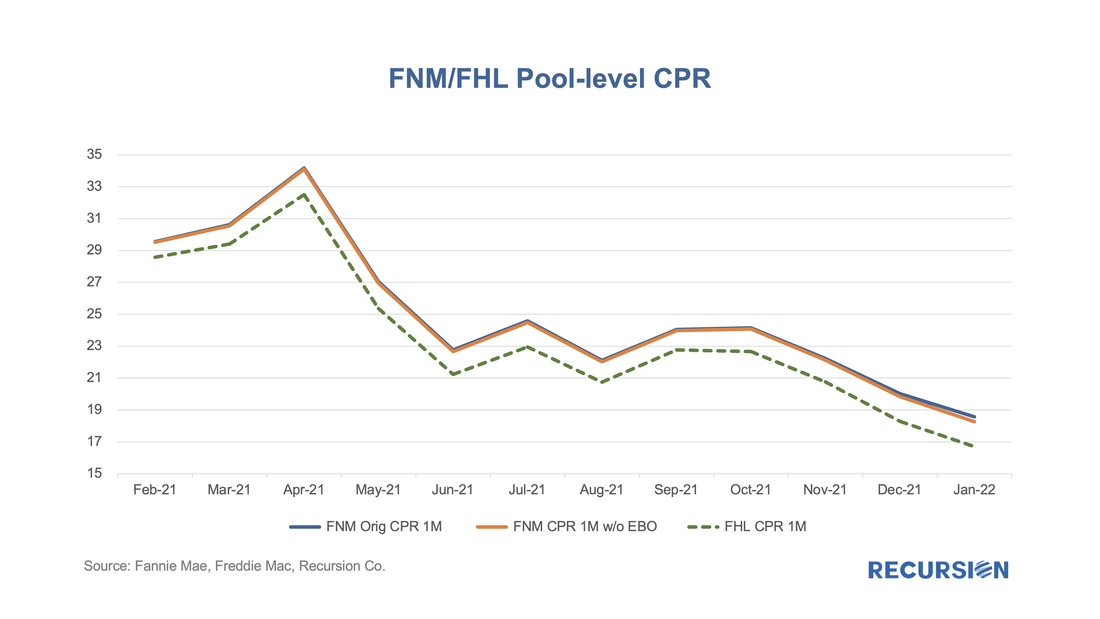

We would expect the magnitude of the impact on CPR’s to be smaller than that on CDR’s given that the much larger number of voluntary prepays were unaffected by the early buyouts. In fact, this is the case with the maximum impact on Fannie’s CPR being 0.3, also in January. The main take-away is that no matter how sophisticated your model, the results are only as good as the quality of the data. [1] https://www.recursionco.com/blog/agency-based-metrics-for-assessing-the-resolution-of-mortgage-forbearance-and-delinquencies-part-ii-the-gses [2] https://capitalmarkets.fanniemae.com/mortgage-backed-securities/certain-sf-mbs-pools-earlier-expected-trial-modification-related-loan-buyouts [3] https://capitalmarkets.fanniemae.com/mortgage-backed-securities/single-family-mbs/list-earlier-expected-modification-trial-buyouts [4] https://capitalmarkets.fanniemae.com/media/22266/display Recursion is a preeminent provider of data and analytics in the mortgage industry. Please contact us if you have any questions about the underlying data referenced in this article. |

Archives

February 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed