|

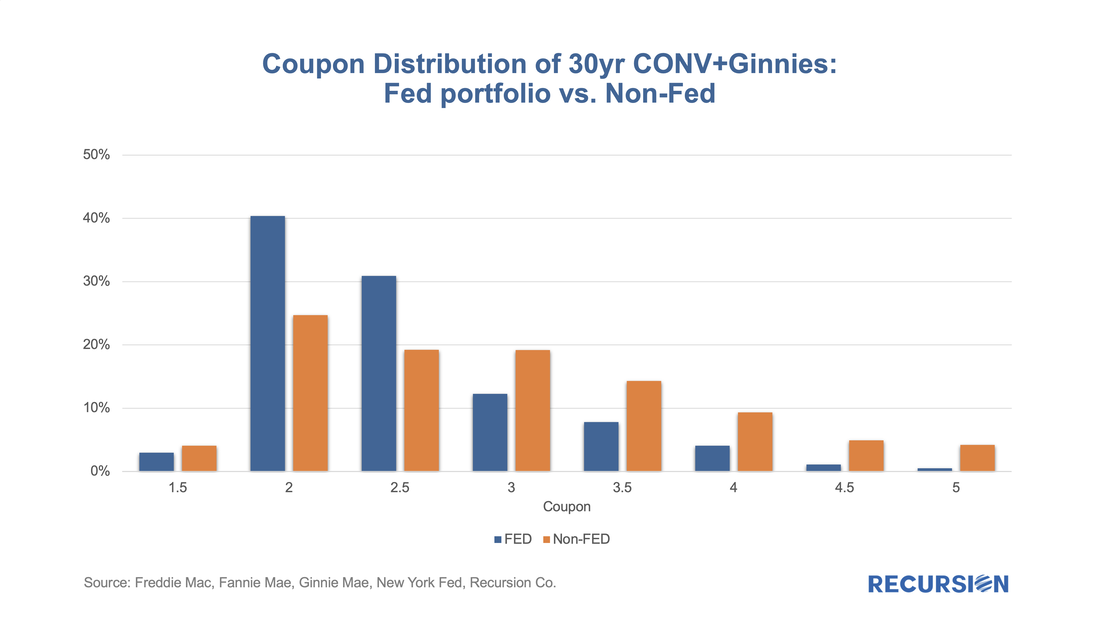

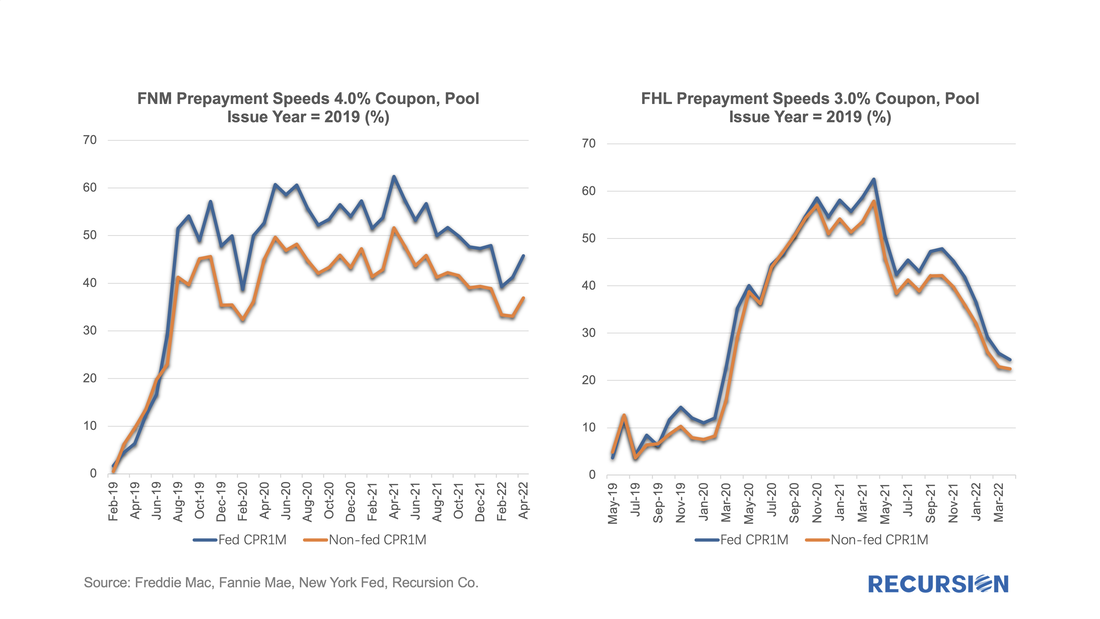

In a recent post, we posed the question: as the Fed’s portfolio shrinks, who will buy[1]? In this report, we dig a bit deeper and look at the differential market impacts based on whether the loans on the balance sheet roll off (as in, for example, a refinance transaction) or are sold off. In the first case, we assume that a mortgage in a pool the Fed holds is extinguished, and a new mortgage is created through a refinance transaction, or via a home sale followed by the purchase of a new home financed by a new purchase mortgage, or through a buyout that generates a new modified loan. This case describes the situation described in the earlier post: a mortgage on the Fed’s balance sheet disappears, and some other investor has to pick up the new loan. The question here is how much higher the yield on the new pools has to be to attract sufficient demand from private investors. These new loans tend to have characteristics that investors find attractive, including a coupon which is near the most liquid part of the market (the current coupon). The second case is quite different. In this instance, the question is how much higher the yield has to be (lower price) for the existing mortgages being sold to find buyers, not for a new mortgage with the most desirable characteristics. In this case, it’s not just a matter of who has the capacity to increase their holdings, but how much additional yield investors will be required for characteristics that are less than pristine. These are challenging issues that we can’t offer precise solutions to, but one way to approach the issue is to see how different the Fed’s portfolio looks from those held in the private sector. To conduct this exercise, we look at two characteristics. The first is the coupon distribution of what the Fed holds vs. the portfolios held by private investors. This rather technical exercise can be conducted by supplementing the data provided in the Agency disclosures contained in our Pool-level Analyzer with the central bank’s holdings provided by the New York Fed[2]. In fact, the distinction is quite notable for 30-year fixed-rate mortgage pools: With the 30-year mortgage rate above 5%, the most active coupons are 4% and 4.5%. These form just about 5% of the Fed’s holdings vs. almost three times that contained in private portfolios. Outright sales of 2% and 2.5% coupons will likely impact the market quite differently from a situation in which a low coupon mortgage is extinguished and replaced by a loan with a more liquid coupon. The next characteristic is prepayment speeds. The Fed buys its mortgages in the To-Be-Announced (TBA) market[3]. Buyers agree to purchase a mortgage pool with certain characteristics, such as coupon, vintage, underwriting characters. The seller has every incentive to provide the worst-allowable pools within the set parameters, for example the mortgages that have the highest prepayment speeds when they are priced at a premium. Given that the Fed holds about $2.7 trillion in MBS pools, it’s reasonable to ask if the performance of these is different from those held in private portfolios. Below find comparisons for two distinct cohorts: In both cases, it is clear that the Fed holdings in these cohorts post inferior performance to those held in private portfolios. Again, the impact of direct sales of these securities is unlikely to be similar to a situation where mortgages are extinguished and replaced with new loans. In conclusion, the Fed monetary policy toolkit is not just composed of setting the short-term interest rate target and the size of the portfolio, but also consists of decisions related to the means by which the size of the portfolio is adjusted. As outright sales have not been used up to this point, it seems clear that caution needs to be employed when considering such an action. The market recalls that the mere mention of the word “taper” in 2013 resulted in immense market turmoil. [1] https://www.recursionco.com/blog/the-feds-holdings-of-mbs-will-decline-who-will-buy [2] https://www.newyorkfed.org/markets/soma-holdings [3] https://www.newyorkfed.org/medialibrary/media/research/epr/2013/1212vick.pdf Recursion is a preeminent provider of data and analytics in the mortgage industry. Please contact us if you have any questions about the underlying data referenced in this article. |

Archives

February 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed