|

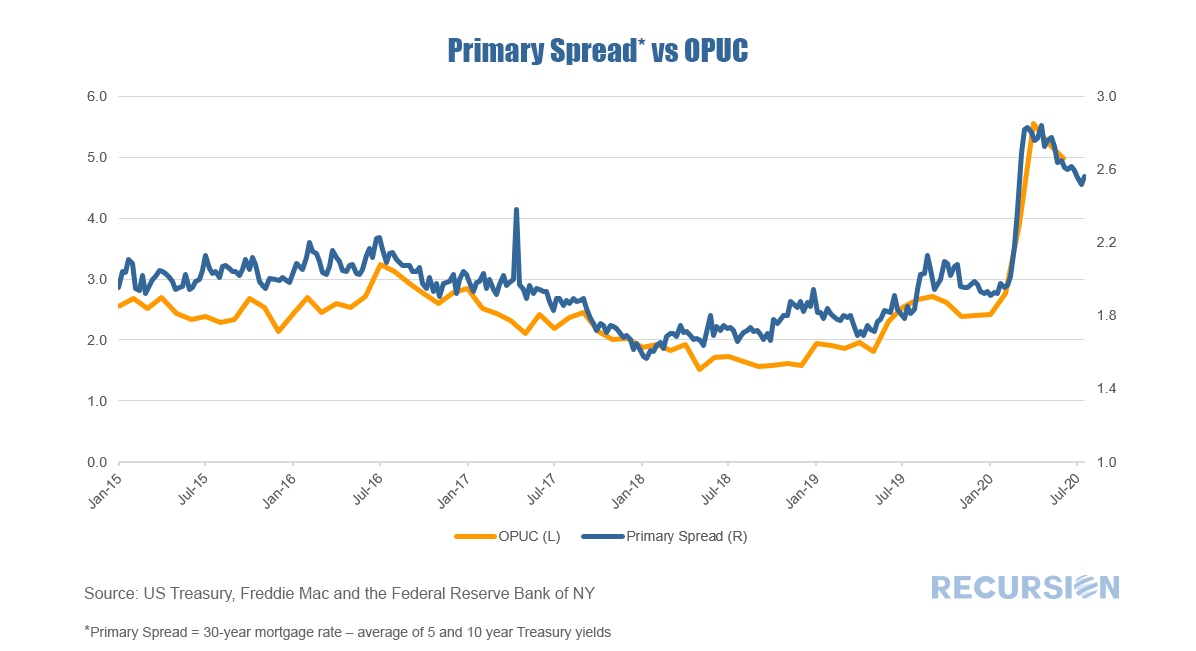

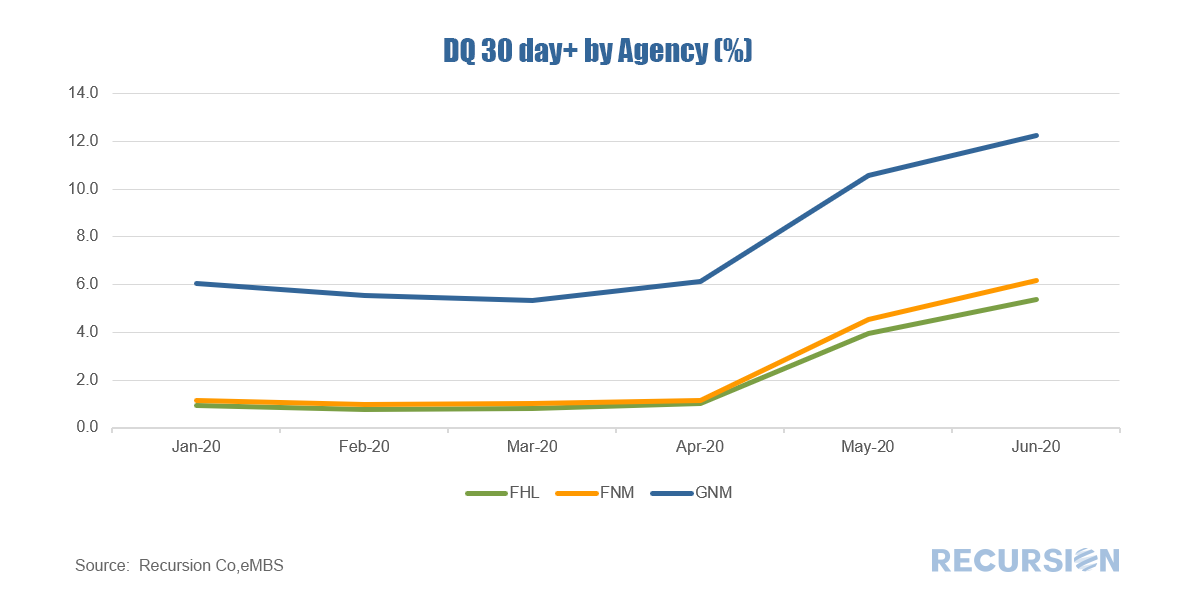

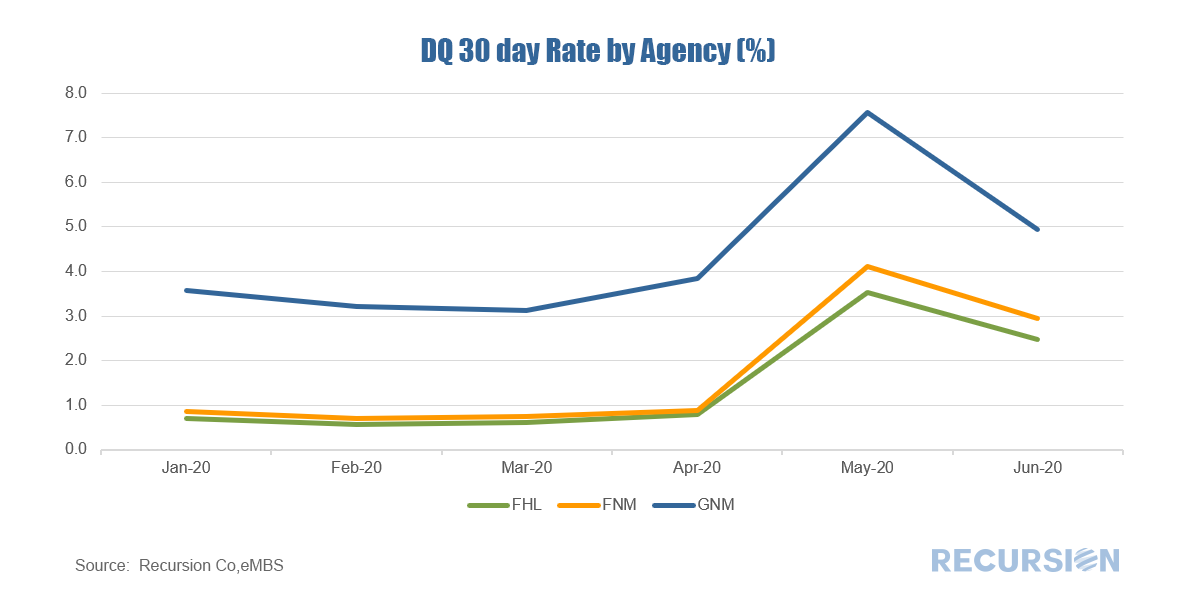

One of our major rules at Recursion is that we are a fintech data and analytics company and that we don’t give investment advice. So spoiler alert: the answer to the question is that anything is possible. But we noticed in the most recent weekly Freddie Mac survey that the 30-year mortgage rate edged up to 3.01% from a record-low 2.98% the prior week, the first sub-3.0% level ever recorded. Market lore says that at a certain level, rates give lenders sticker shock and mark a point below which they are reluctant to venture. In an early blog post we noted that mortgage rates were at record lows, but that Treasury yields were deeper into record-low territory, so mortgage spreads were actually quite wide[1]. Mortgage rates are set in the market reflecting offsetting pressures including: downward pressure from Federal Reserve purchases, upward pressure from record demand, and the costs of forbearance borne by servicers that they seek to recoup with higher margins on new business. Below is an update to the March chart with a new variable added: the inelegantly named OPUC: OPUC is “Operating Profits and Unmeasured Costs” and is described in a NY Fed Report[2]. While oversimplifying, it reflects what a lender can get for a loan it sells to investors minus the g-fee. These are (with a raft of assumptions) measurable. Breaking down profits from unmeasured costs is a challenging exercise but we note that total delinquencies rose steadily in the first half of the year, implying an increasing weight of the “UC” part of the acronym. What does all this mean going forward? First, total losses will increase or decrease depending on cure rates and new DQs, which largely reflect labor market conditions. Second, who bears the losses will change. In particular, for conforming loans, the GSEs will begin to bear losses directly once servicer obligations cease after four months of missed payments[3]. The future path of rates depends on a myriad of assumptions made about the performance of the economy, the path of the Covid-19 pandemic, and various policy decisions. There is never a crystal ball, and the view now is hazy to an unprecedented degree, which points to the need to develop new frameworks for analysis and new tools to support them. [1] https://www.recursionco.com/blog/the-new-normal-in-mortgage-rates

[2] https://www.newyorkfed.org/newsevents/news/research/2013/rp131112 [3] https://www.fhfa.gov/Media/PublicAffairs/Pages/FHFA-Addresses-Servicer-Liquidity-Concerns-Announces-Four-Month-Advance-Obligation-Limit-for-Loans-in-Forbearance.aspx |

Archives

February 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed