|

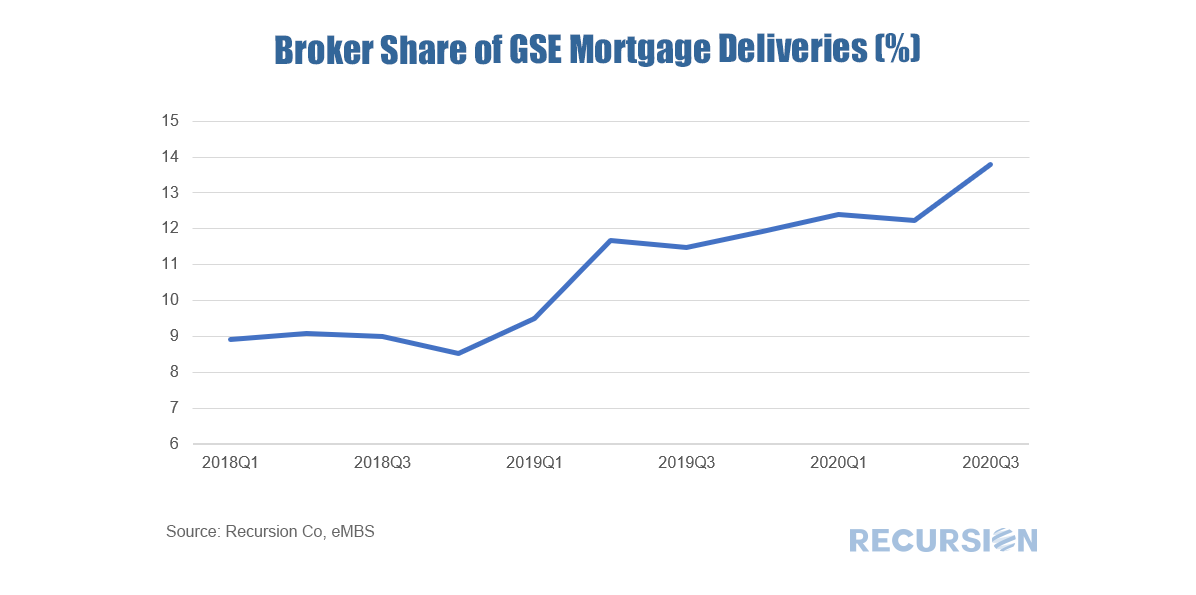

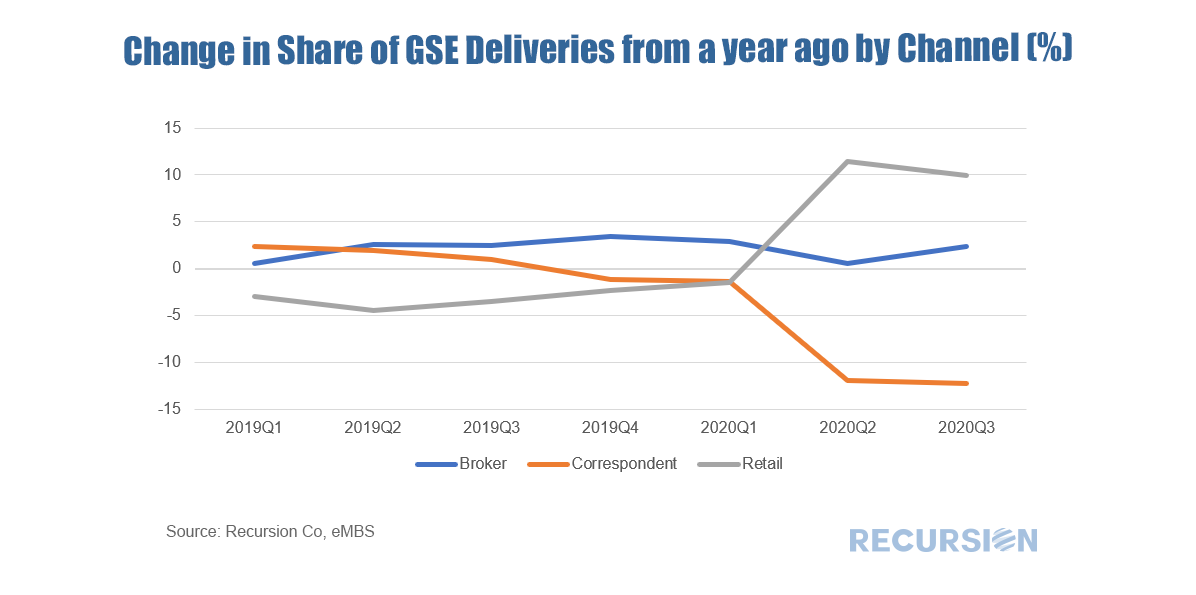

We have posted numerous blogs about how Covid-19 has served to accelerate structural change in the mortgage market, particularly in the growing share of nonbank mortgage sales to the GSE’s[1]. It’s natural in such an environment to look at deliveries by channel. As has been widely noted in the industry, the broker channel enjoyed a considerable increase in market share over the 2018-2019 period, as the broker community became better organized[2]. Has this trend continued with the onset of the Covid-19 crisis? The answer is apparently yes. The uptrend during the second and third quarters of 2020 is similar to that experienced in the first half of last year. But as the broker channel has gained market share, who has lost? It turns out that this story is more nuanced. The chart below shows the yr/yr share change for the broker, retail and correspondent channels: From early 2019 to 2020, the gain in the broker share of the market came largely at the expense of the correspondent channel. While the retail channel lost share during this period the rate of decline decelerated. The onset of the Covid-19 pandemic resulted in a massive switch from the correspondent to the retail channel, perhaps as surging volumes precluded sellers from needing to purchasing loans from others to fill production pipelines. It is interesting to note that the jump in market share of the retail channel at the expense of the correspondent channel was a surge in a trend that was already in place. Finally, while the sharp recent gain in the nonbank share of deliveries is to a large extent evidence of the importance of advanced technology in housing finance, new complexities associated with the market and policy reactions to the pandemic continue to underscore the need for tailored personal advice which brokers provide. |

Archives

February 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed