|

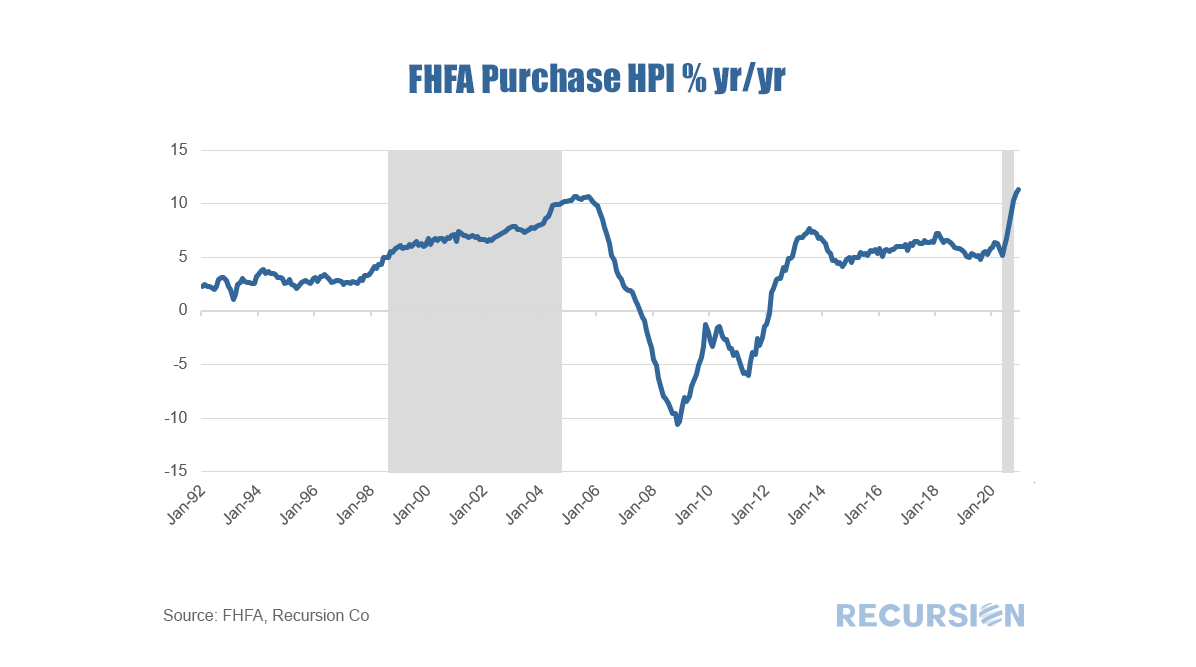

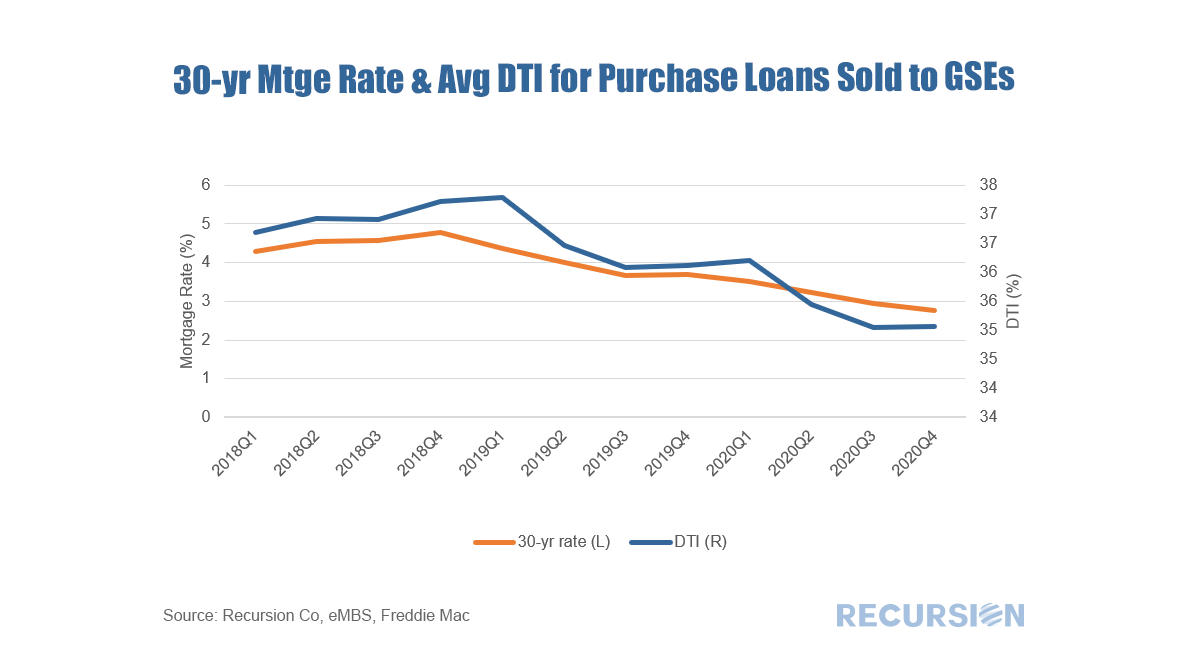

On Tuesday February 23, FHFA released its monthly purchase-only HPI for December, showing a 1.1% rise from the prior month, and a striking 11.1% increase from December 2019, the record-high annual growth rate reported since this data was first released in the early 1990s. Beyond the magnitude of the rise, what is remarkable is the acceleration in the recent rate of growth. During the housing bubble period in the early 2000s, it took over 6 years for the HPI year-over-year growth rate to accelerate from 5% to 10%. With Covid, this same feat was accomplished in just 5 months! On the morning of Thursday February 25, 2021, Freddie Mac released its weekly mortgage rate survey showing the 30-yr fixed mortgage rate rising by 0.16% to 2.97%, a 6-month high. Later in the afternoon of the same day, the 10-yr Treasury rate soared by 0.20% to 1.60%, a 12-month high, before settling down to 1.53% at the end of the trading day. Growing economic optimism stemming from reduced virus counts and likely fiscal stimulus is resulting in traders repricing risk in the fixed income markets. Is this enough to stem the tide of rising home prices? The acceleration we have experienced appears well-grounded in the new demand fundamentals associated with the fallout of the pandemic. Besides the stimulus plan, the policy menu being discussed includes new infrastructure spending, a first time homebuyer tax credit, and student loan forgiveness, all of which can be expected to underpin the housing market. And mortgage rates are still exceptionally low, as recently as late 2018 they were just under 5%. Historically, there is a tendency for the lenders to “lean against the wind” when mortgage rates move through adjustments in their credit overlays. When rates rise (fall), they expand (contract) the credit box they use to determine eligibility. When mortgage rates rose in 2018, they loosened their standards. The chart above shows this through the lens of the average DTIs of their deliveries.

This is a very complex topic and we cannot do it justice here, but the point is that banks have plenty of room to expand their credit boxes to keep pipelines full based on the standards seen in recent years. In the long-term tradition of Recursion policy whereby we do not ever give financial advice, the answer to the question is “not necessarily”. |

Archives

February 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed