|

As we careen towards 2021, it’s getting to be time to look down from the top of the roller coaster towards the abyss below. The view is extremely hazy, but fortunately we have big data tools at our disposal to help clarify things. In mortgage space the single main question is what’s going to happen when forbearance expires. This program was designed to run out after a year, and that will be coming up starting next spring. If you are in forbearance and your time runs out, you have three choices:

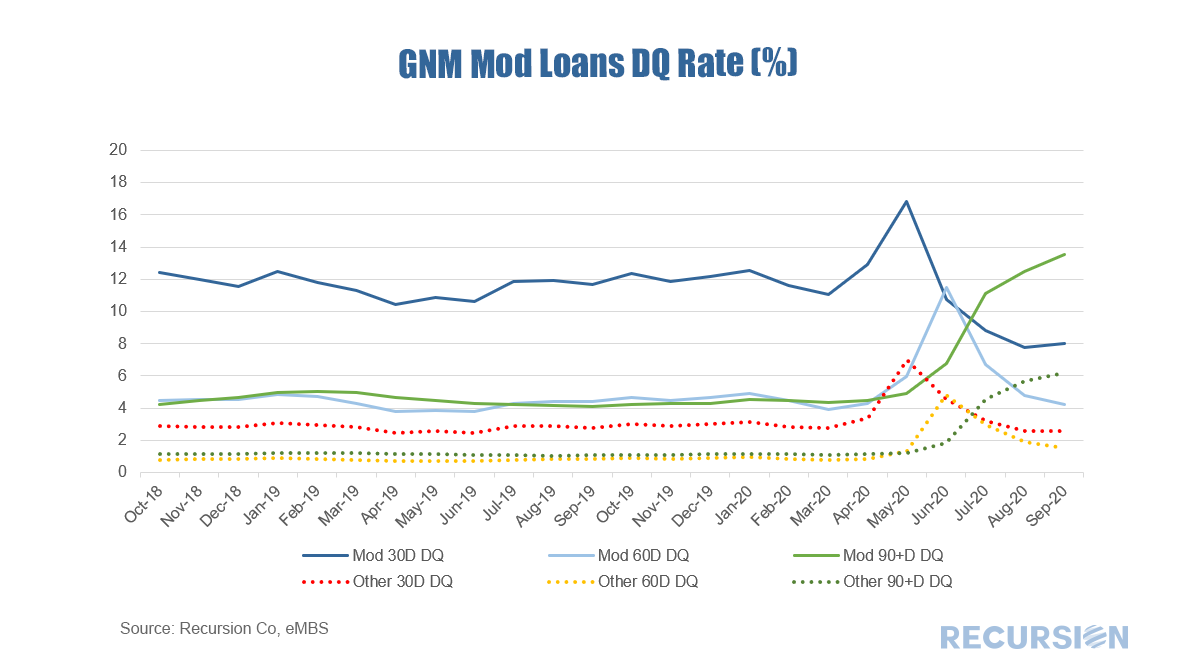

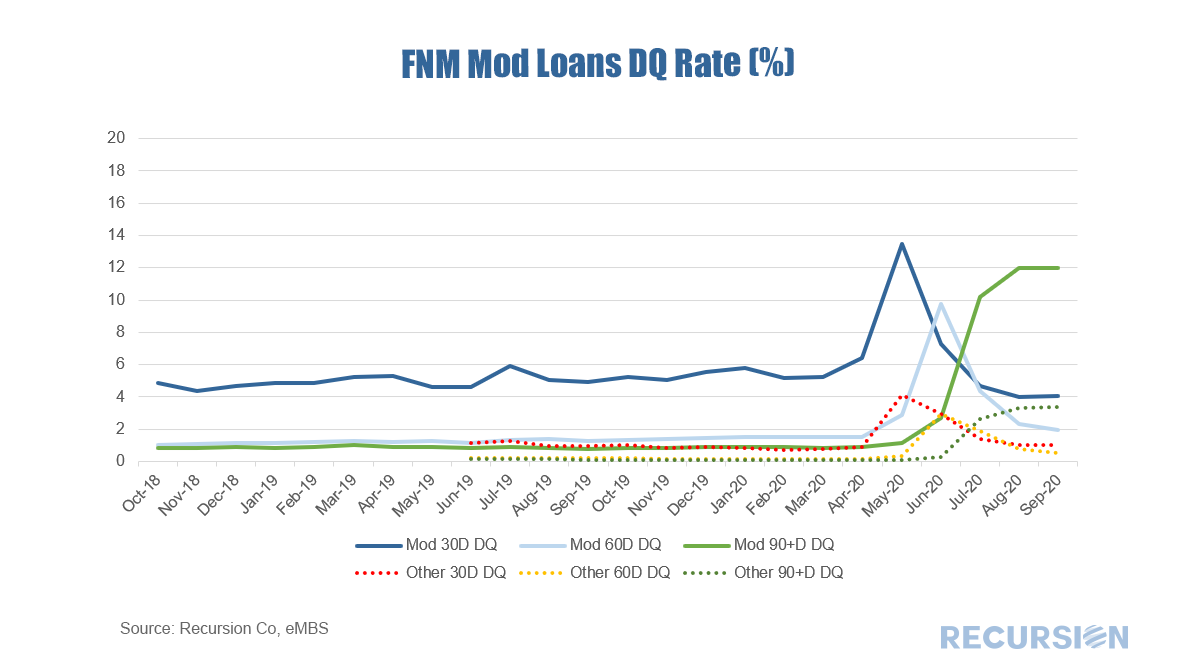

Like all things related to mortgages, this is far more complicated than it appears. According to the Mortgage Bankers Association, 5.9% of mortgages are in a forbearance program[1]. The NY Fed tells us that outstanding mortgages amount to about $10 trillion.[2] So large numbers are involved. The main market focus is on the distribution of outcomes when forbearance ends. This depends on a number of factors including the strength of the economy and the effectiveness of public health policy, as well as the financial condition of mortgage lenders and servicers. None of these are easy to predict. So we monitor. It turns out that two of the three mortgage agencies release delinquency information on the performance of modified loans in their books of business, Fannie Mae and Ginnie Mae. This is fortunate as differences in the structure of the GSE and Ginnie securities is very important in assessing the ultimate outcome here. This discussion, however, will have to wait. For now, let’s just look at how modified loans have performed compared to other loans for these two agencies. As of October 1, the share of mods in Ginnie’s book is 3.7%, and 1.3% for Fannie Mae. Unsurprisingly, modified loans post worse performance than others, but there are some wrinkles in this worth noting. In Ginnie space, 30 days delinquency rate peaked at 16.8% vs 7.0% for others. For Fannie Mae the numbers were 13.5% and 4.1%, respectively. So delinquency rates for Ginnie programs are distinctly higher than for Fannies. In recent months 30 days delinquency rates’ have fallen sharply as the labor market improved for both agencies. The pattern is similar. For 90+ days, the story is quite different. Serious delinquency rates have continued to steadily rise in Ginnie programs, especially for mod loans. In October they stood at 13.9% for mod loans and 6.4% for others. For Fannie Mae loans the rate has flattened out, with 90+ days delinquency rate’s declining slightly to 11.8% from 12.0% in September for mod loans and to 3.2% from 3.4% for other loans, respectively. The trend in the pattern here may provide some guidance as to the ultimate disposition of these loans once forbearance runs out, as well as to the ultimate success rate of new loans headed into modification. More to come. |

Archives

February 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed