|

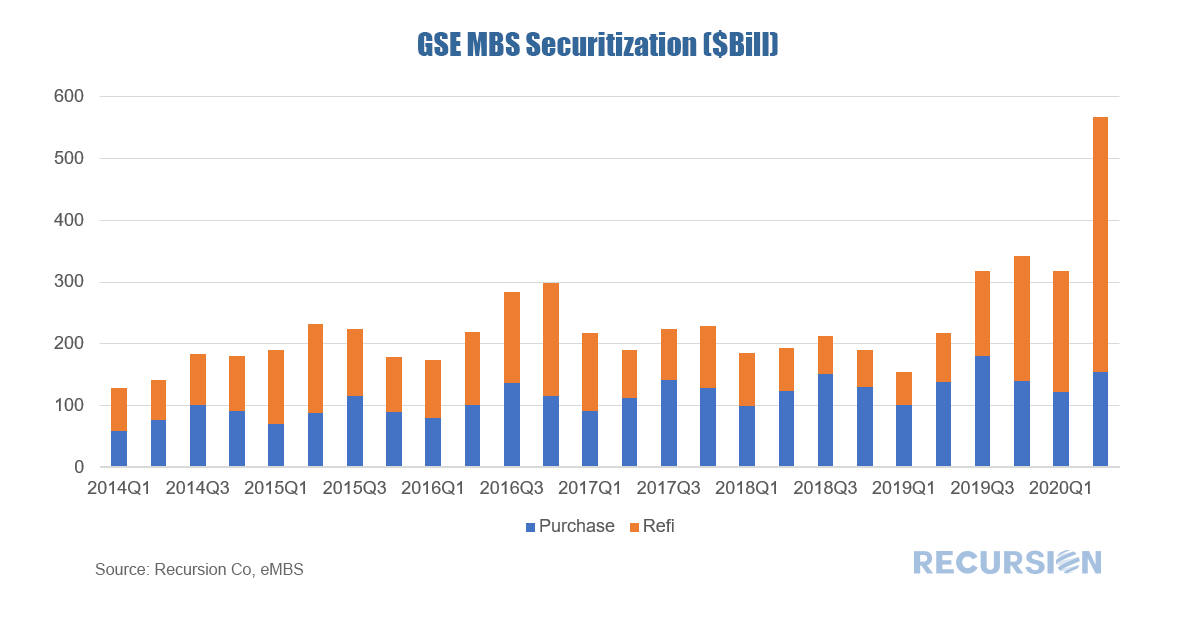

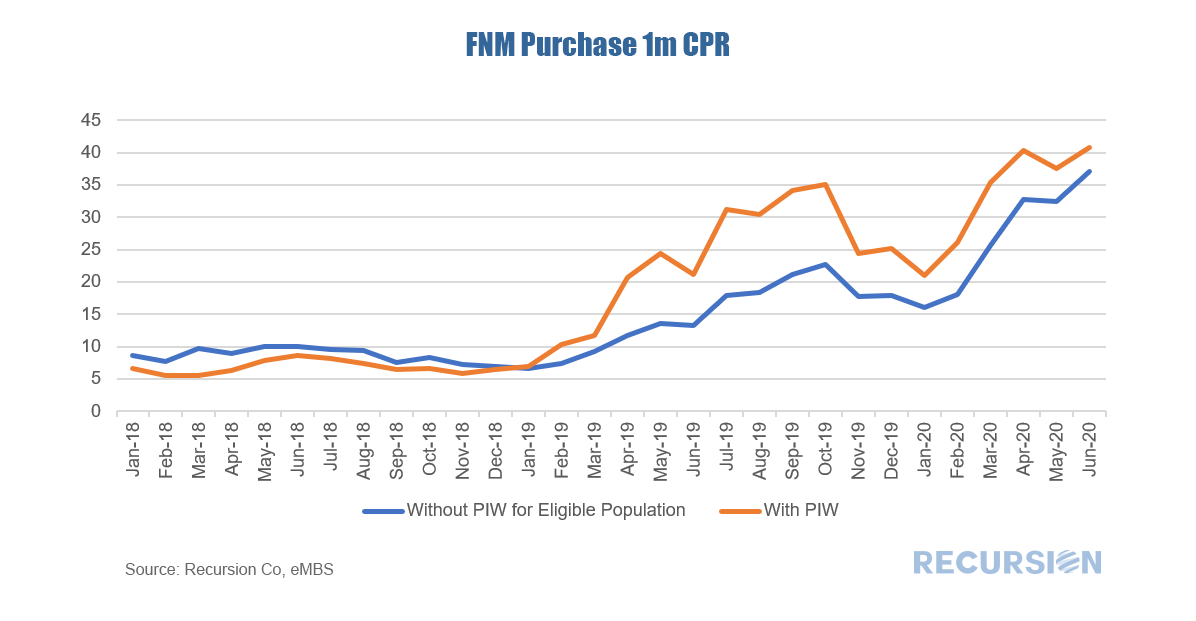

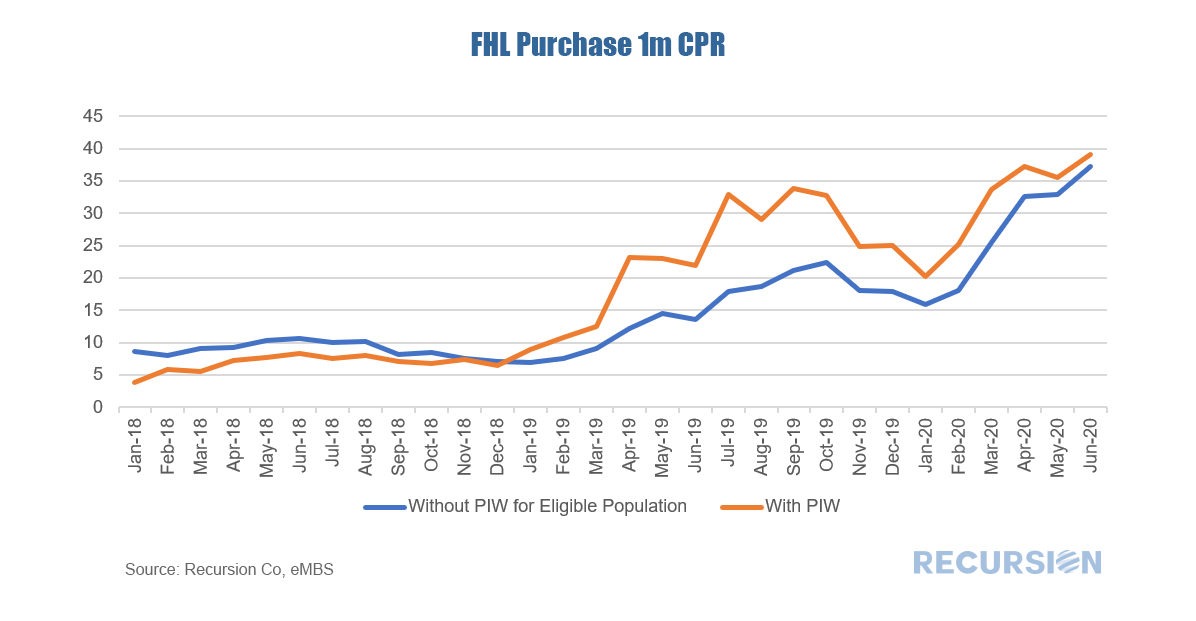

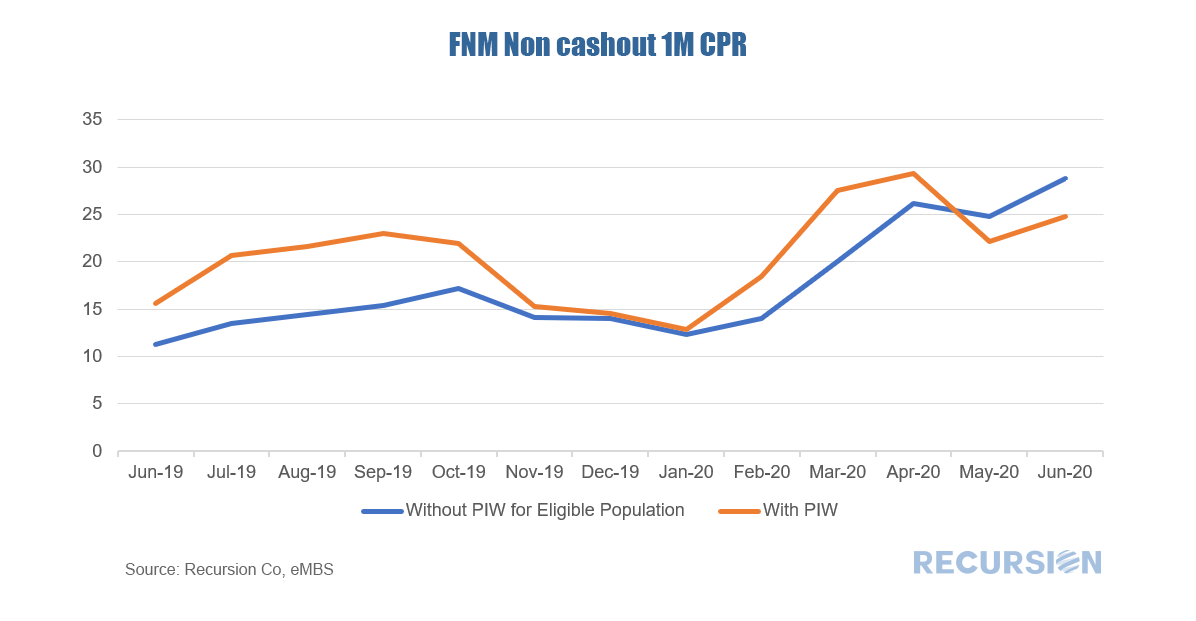

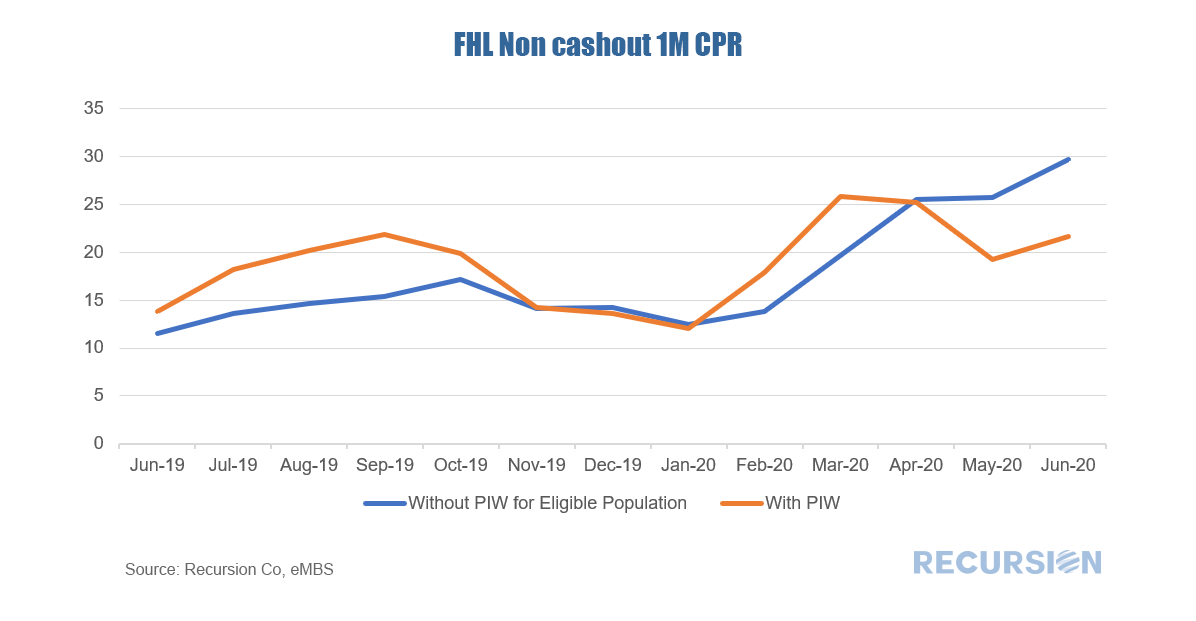

The drop in the 30-yr mortgage rate to close to 3.0% has worked to keep purchase mortgage securitizations relatively steady while refinancing activities have soared to record highs. Refis in Q2 2020 for the GSE’s came in at more than twice the next highest quarterly figure reported over the past seven years: Besides the sharp drop in rates, another factor in this sudden surge compared to previous years is the increasing use of Property Appraisal Waivers. With the transaction costs of refinancing going down as a result, it appears that refis accelerated compared to prior episodes of falling rates. To look at this a bit deeper, below find 1-month prepayment speeds of both PIW loans and PIW eligible purchase loans for the two agencies[1]: For both agencies, it appears that loans with appraisal waivers prepay faster than eligible loans without, but the impact diminishes over time in part because there are fewer such loans with a PIW left that haven’t prepaid. In fact, for non-cashout refis the impact is even more pronounced: In this case not only have prepayment speeds for this category of loans with appraisal waivers slowed relative to others, but in the last couple of months they have actually become slower compared to other eligible loans. A combination of unprecedented policy moves and market developments have served to upend conventional mortgage market analysis, underscoring the need for new thinking, and new tools. [1] For a description of eligibility criteria see https://www.recursionco.com/blog/property-inspection-waiver-eligible-population

|

Archives

February 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed