|

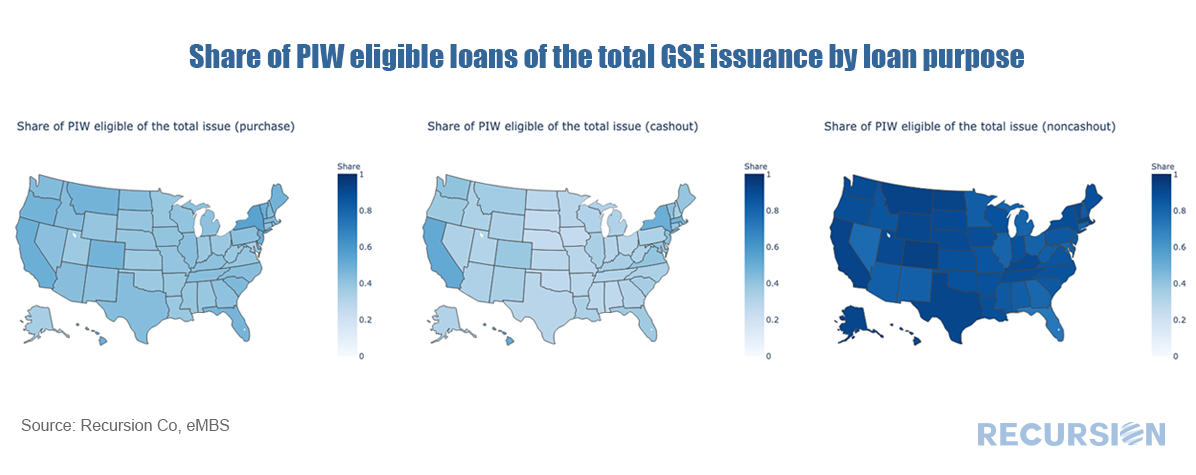

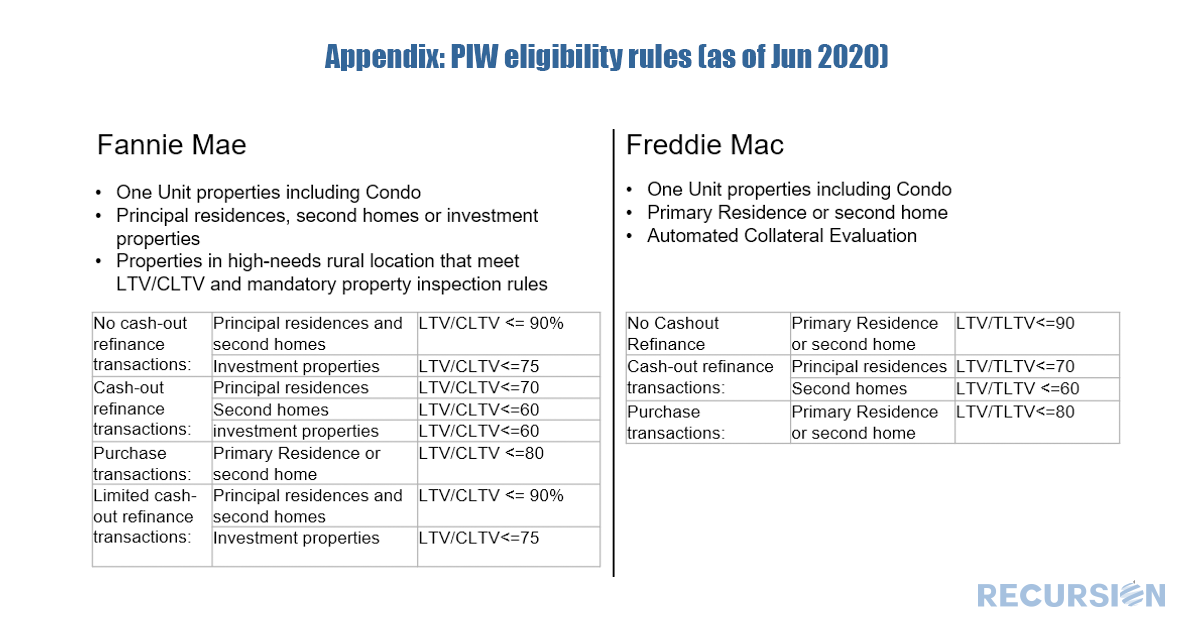

Appraisals play an important role in managing the risks associated with residential mortgages. Since 2017, both Fannie Mae and Freddie Mac (GSEs) have published multiple rules (see Appendix below) for lenders to qualify mortgage applications for property inspection waivers (PIW). PIW can reduce the cost of mortgage transactions. However, PIW raised concerns of improper usage among investors, mortgage insurers, regulators and other players in the mortgage market. In particular, research has shown that loans with PIWs prepay much faster than loans without. In March 2020, both Fannie Mae and Freddie Mac released loan level information regarding “Property Valuation Method” which included the Appraisal Waiver information. The new data regarding PIW’s offers the opportunity to study how this program affects the market. The first issue is to determine the size of the eligible population. Growth in the PIW market share may be a result of higher eligibility usage, or a higher granting rate within eligible loans. To compare apples to apples, we made the PIW eligibility flag available on Recursion Cohort Analyzer. The rules differ by loan purpose[1]. For GSE newly issued purchase loans, the shares of PIW eligible portion [2] for each state are between 34.7%(DC) and 55.1% (NY), with a median of 42.0%. For regular cashout refi loans, the shares are between 25.6% (IA) and 53.1% (DC), with a median of 32.7%. For noncashout refi loans, the shares are significantly higher than the other categories, with a range between 72.2% (FL) and 94.7%(DC). Recursion Cohort Analyzer makes it possible to do cross studies between PIWs and other factors. In future posts, we will look at how PIWs interact with factors such as underwriting characteristics and banks/nonbanks. [1] This analysis excludes the Fannie Mae PIW rules regarding high-need rural areas.

[2] Total GSE issuance is calculated by the total GSE loans issued between Jan 2017- June 2020 |

Archives

February 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed