|

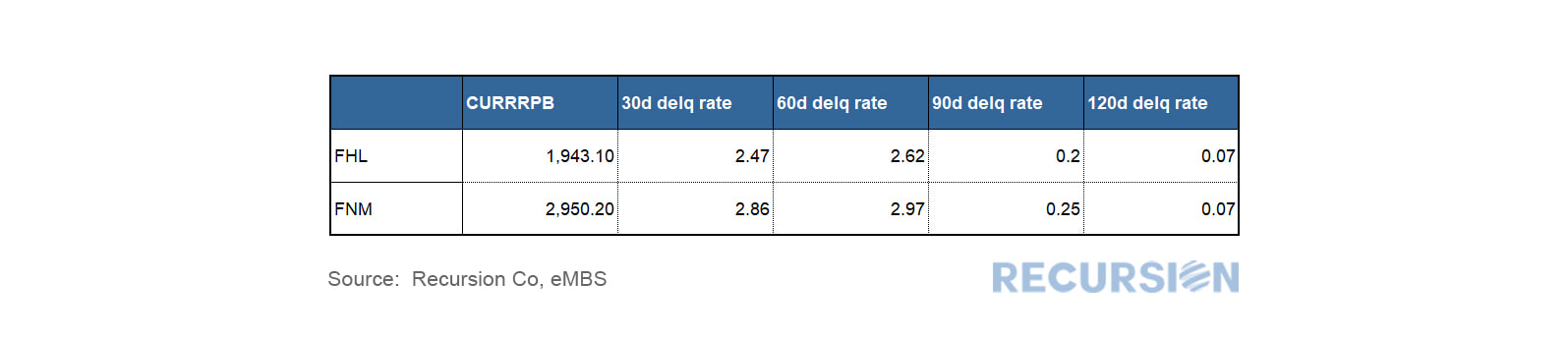

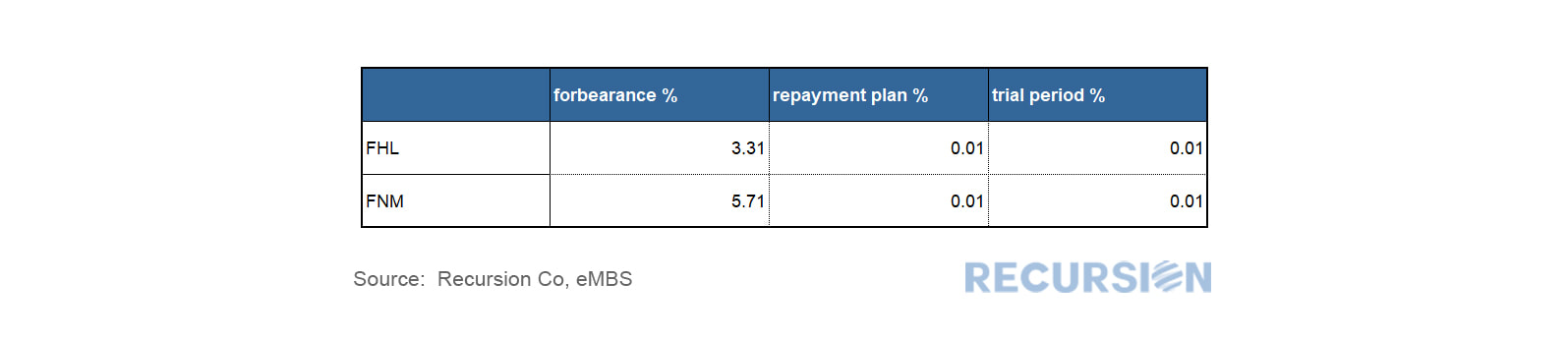

We received delinquency and forbearance information for the GSE pools late last night. By balance, the pools with such information cover over 99% of FHL and 92% of FNM pools, which is satisfactory. In terms of delinquency, Fannie Mae reported higher delinquency rate than Freddie Mac, which is in line with the relatively higher DTI’s seen in FNM deliveries in recent years. Freddie’s 30d delinquency rate reported in May was 2.47%, about 0.4% below the same figure for Fannie Mae . Freddie Mac’s forbearance exposure is reported as 3.31%, significantly below the figure for Fannie Mae’s which came in at 5.71%. The Mortgage Bankers Association reported that forbearance rates at the end of May for the GSE’s was 6.39%, suggesting some underreporting in the pool data, particularly for Freddie Mac. Freddie’s overall forbearance rate is lower than its total delinquency rate, (sum of delinquencies is 5.34%) which is very unlikely.

Looking closer, we found only 4% of Freddie pools have a larger forbearance balance than delinquency balance, while the same figure for Fannie Mae has 53%, by balance. Both agencies have large numbers of pools with forbearance equal to delinquency, however, those tend to be very small pools (average pool size smaller than 3mm). The underreporting of forbearance data, particularly for Freddie Mac, is disappointing, but the delinquency data appears to be broadly in line with market realities and can form the basis for future analysis. |

Archives

February 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed