|

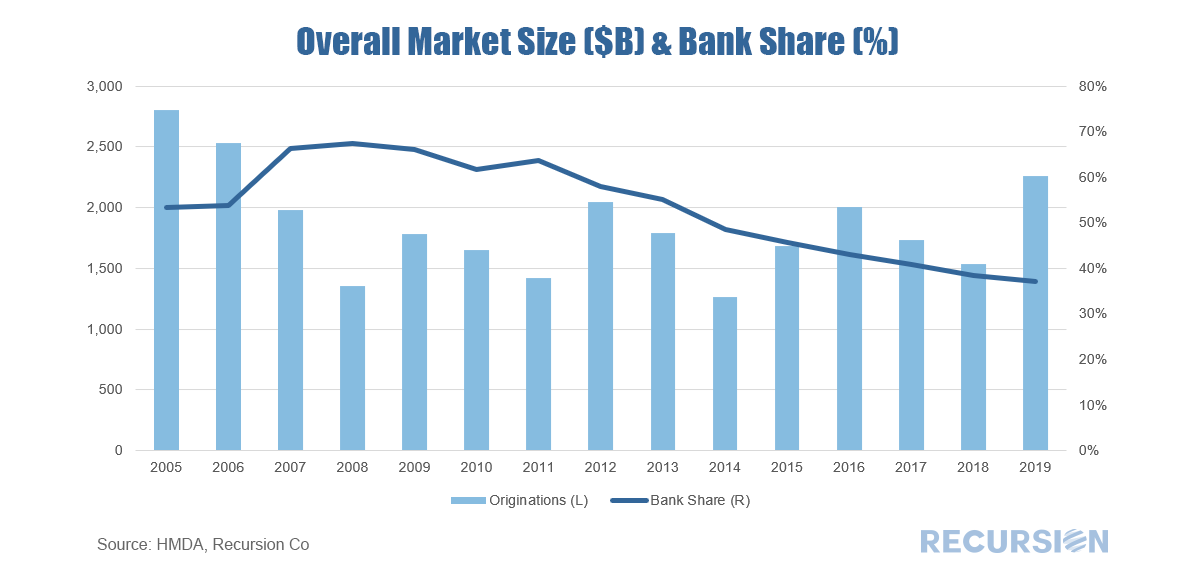

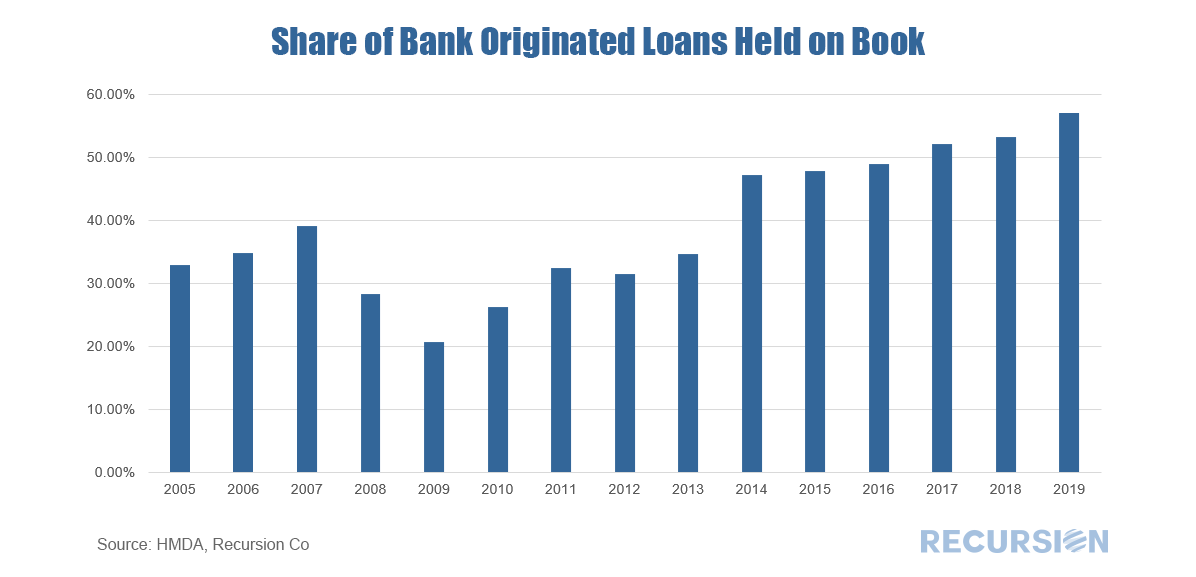

2019 HMDA data has been released and is loaded into Recursion’s HMDA Analyzer so clients can perform consistent queries back to 1990. As always, a vast wealth of information is available. Below are several high-level observations. First, total originations rose by over $700 billion compared to 2018[1], a 13-year high. The bank share fell for the eighth consecutive year, reaching a record low of 37%. This was down 1 percentage point from 2018, the smallest decline posted for 8 years. Nonetheless, banks have suffered a remarkable 30-point drop in market share since 2008. It’s interesting to note that the decline in bank share persists in both purchase- and refi-driven markets. An important HMDA data point is the share of loans originated by banks that are held on book. As it turns out, this statistic for 2019 rose by 3.8 percentage points to 56.9%, near the top of the range observed over the past six years. Over the period from 2014-2019 mortgage fundamentals were very strong, with low levels of unemployment and modestly rising home prices. In the new normal of the COVID-19 world, these assumptions are on shakier ground. [1] These are for closed-end loans only. 2018 and 2019 HMDA data contain information on open-end loans (e.g. HELOC’s) and these are excluded from this analysis.

|

Archives

February 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed