|

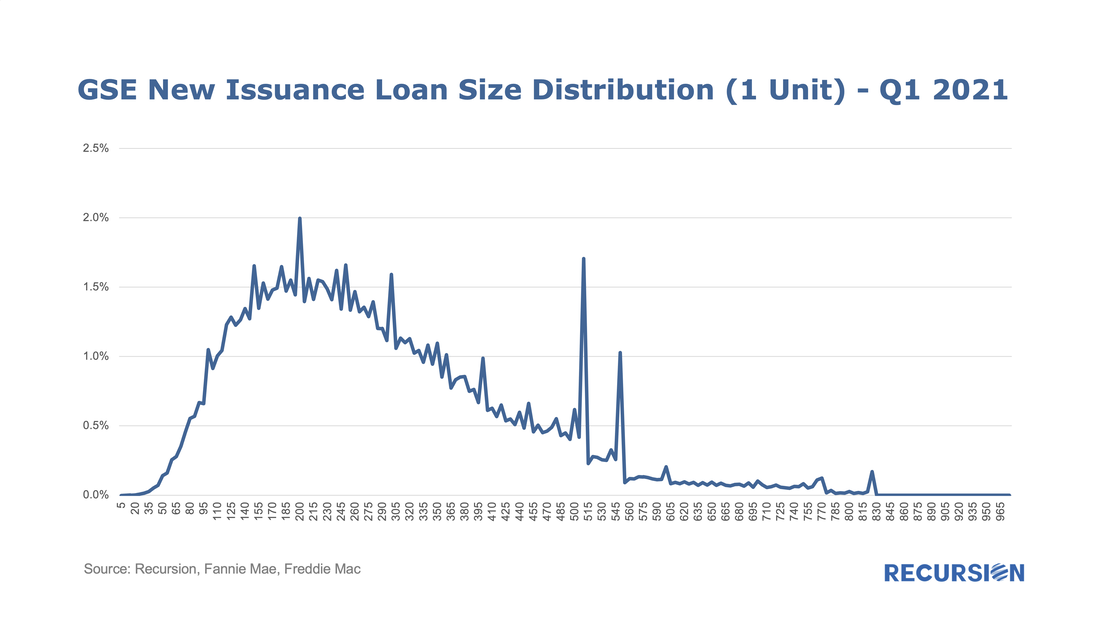

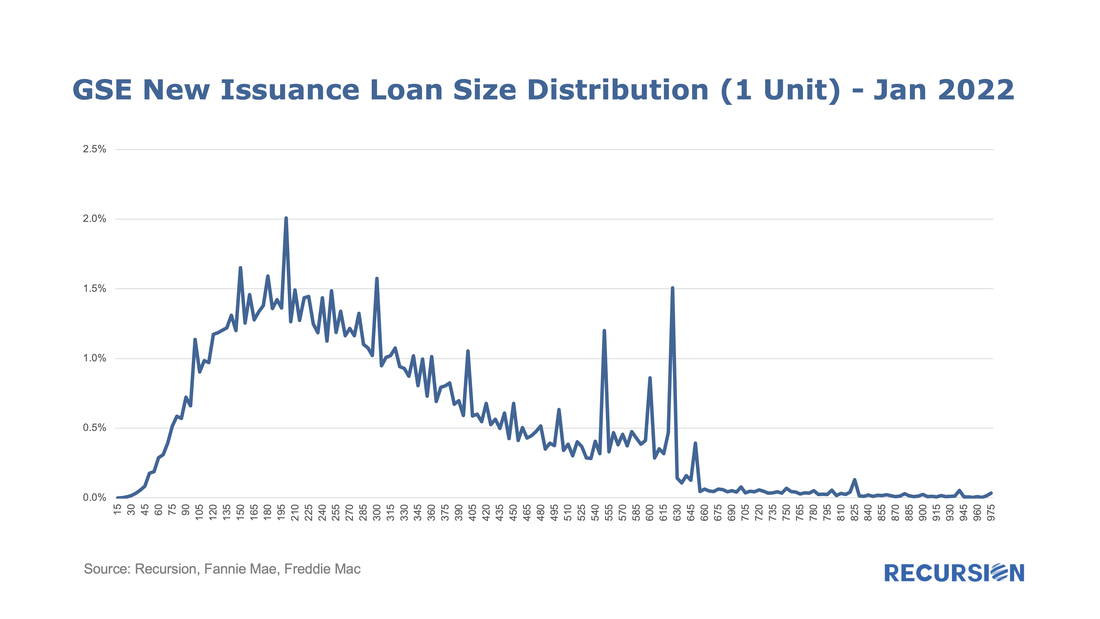

On December 30, 2021, FHFA announced that the baseline conventional loan limit for 2022 would rise by $98, 950 to $647,200.[1] The new ceiling for high-cost areas is set at 150% of the baseline limit or $970,800. Since loan limits apply when they are delivered to the agencies, not when they are originated[2], it would be of interest to look at the pace at which loans reaching to the new limit are delivered at the start of the year. The chart below shows the distribution of mortgages delivered to the GSE’s in Q1 2021 by loan size($K). You can see a large spike near the 2020 loan limit of $510,400 and another smaller spike at the 2021 limit of $548,250. Here is a similar chart for January 2022: Again, we see a similar “double-spike” shape, but this time the new spike is at 625K, 22K lower than the 2022 conforming limit, and the spike is higher than the one for the 2021 limit. This is that evidence that the extraordinary surge in house prices last year led to an increasing number of sales financed by mortgages above the 2021 limit and held in portfolio by the lenders waiting until the new limits came into effect in January, and lenders bet the new limit would be no lower than 625K. Insofar as mortgage performance, particularly prepayments, are associated with loan size, the implication is that prior year patterns in delivery cannot be assumed to persist in an ebullient housing market. [1] https://www.fhfa.gov/Media/PublicAffairs/Pages/FHFA-Announces-Conforming-Loan-Limits-for-2022.aspx [2] https://singlefamily.fanniemae.com/originating-underwriting/loan-limits Recursion is a preeminent provider of data and analytics in the mortgage industry. Please contact us if you have any questions about the underlying data referenced in this article. |

Archives

February 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed