|

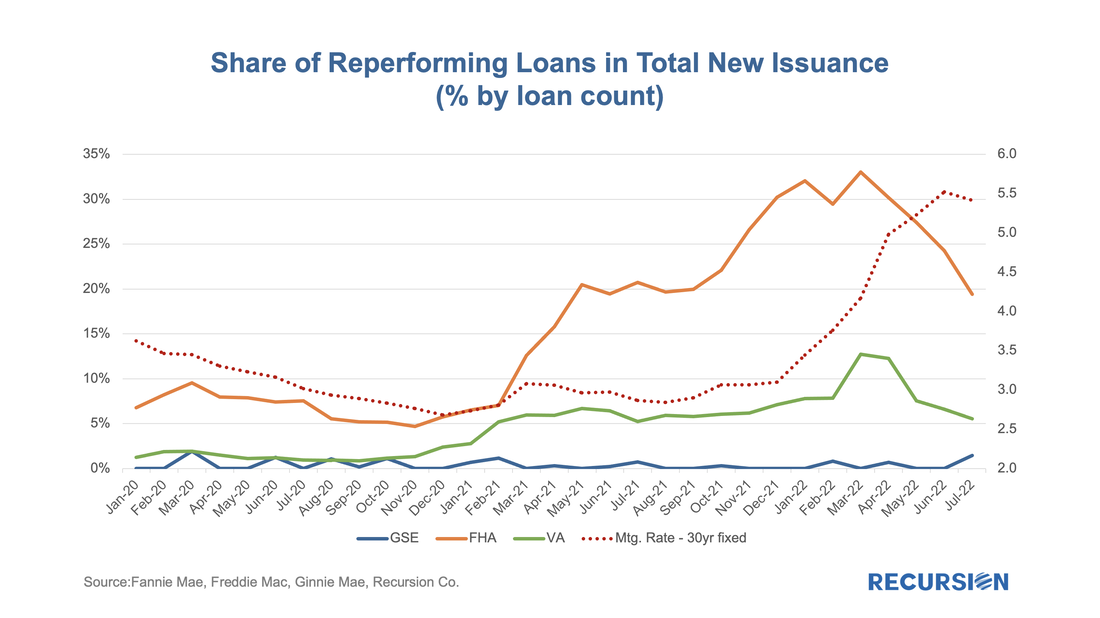

Analyzing trends in market performance requires two things, 1) a lot of data, and, 2) a deep understanding of the structure of markets. We recently came across a good example of this with relative delinquency rates between GNM and GSE pools[1]. In this post, we look at the dynamics of the two categories of reperforming mortgage loans. Investors have spent many years building models of prepayment speeds for mortgage pools based on a variety of characteristics such as loan size and underwriting characteristics. However, institutional factors can come into play as well. One that comes to mind is the difference in program structure between conventional and government loans. For the conforming market, the issuer is a GSE, while for government programs, it is the servicer. In both categories, when a loan becomes seriously delinquent, it can be bought out of the pool at par, amounting to a prepayment. The difference is that for the case of conforming loans, it is the quasi-public GSEs that perform this function, while for government programs, the decision is up to private sector entities. In the first case, there are overarching policy goals that weigh on decisions about the disposition of loans in delinquency, while in the second case, these decisions are based on financial considerations. One way to test this is to look at buyouts over the interest rate cycle. Below find a chart containing the shares of reperforming loans in new issuance for FHA, VA and the GSEs. These are loans that have been previously bought out of pools and then reissued into new pools. There can be a substantial lag between the buyout and re-issuance. For the GSEs, there have been few buyouts and a very small number of redelivered loans. This is likely due in part to the 18-month forbearance period in place for conventional loans[2]. There is no evidence that the level of interest rates is an input to the buyout decision. The situation is entirely different for the servicers of government loans. During a period of low-interest rates, servicers can purchase a premium loan out of a pool at par, modify it and redeliver over par and make a profit. The shares of government reperforming loans are naturally higher with this incentive, particularly for FHA. As reperforming issuance lags buyouts, the higher trend in the government share persisted for about a year after mortgage rates troughed in 2020, reaching its peak of over 30% for FHA in March 2022, as shown in the chart. The pace of this activity is not necessarily very fast as nonbanks which dominate servicing for these loans, often face liquidity constraints. The main conclusion is that models for loan performance in GNM pools should create separate categories for reperforming loans, broken down between voluntary and involuntary prepayments, as the dynamics are quite different. [1] DQ blog [2] See https://www.consumerfinance.gov/coronavirus/mortgage-and-housing-assistance/help-for-homeowners/learn-about-forbearance/ Recursion is a preeminent provider of data and analytics in the mortgage industry. Please contact us if you have any questions about the underlying data referenced in this article. |

Archives

February 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed