|

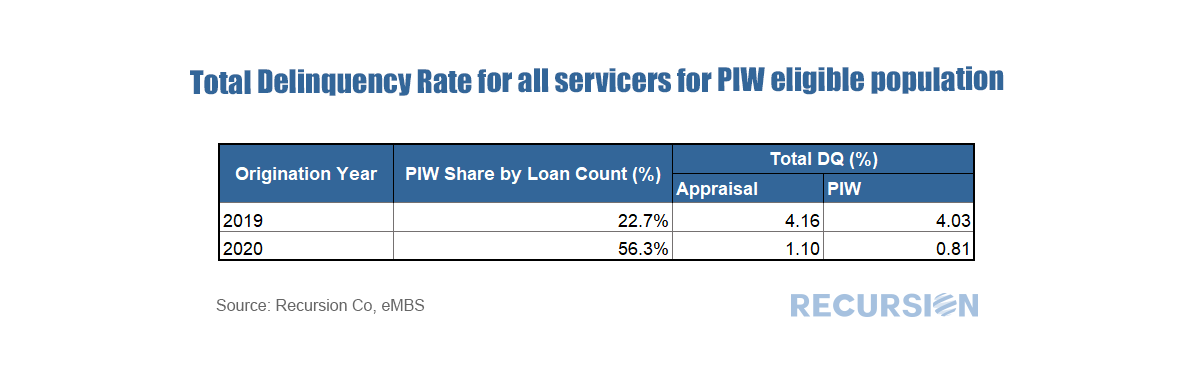

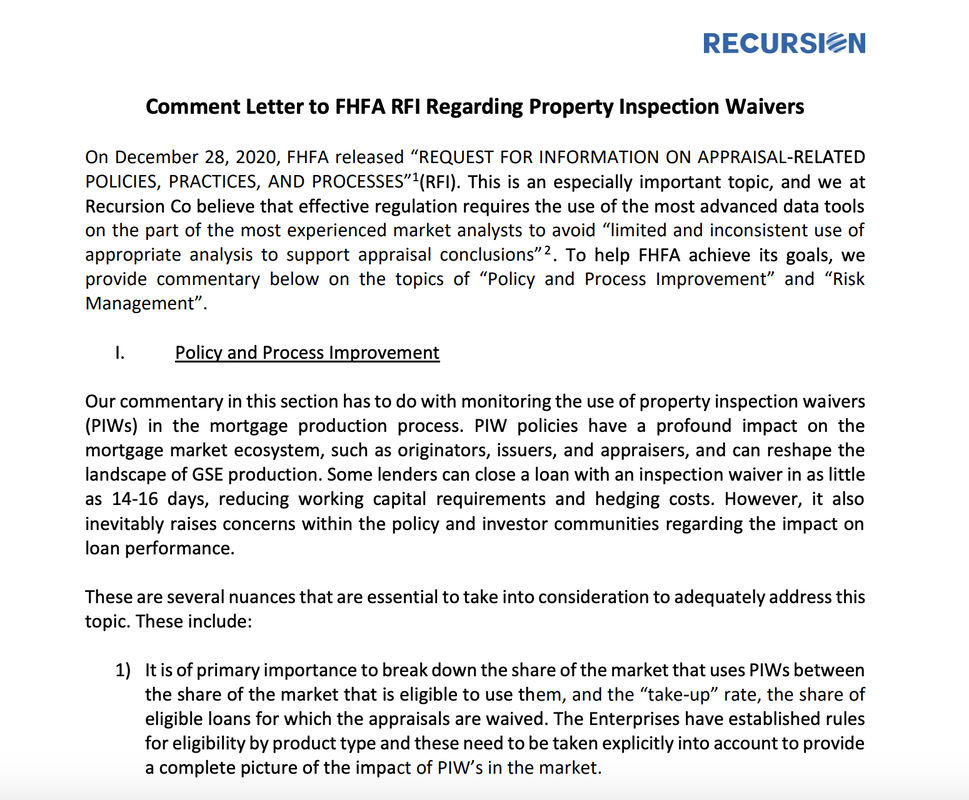

In a recent post, we discussed our comment letter to FHFA regarding policies and procedures related to property inspection wavers (PIWs)[1]. In that note we commented that one of the best ways to assess the impact of the program is to look at the performance of loans with appraisal waivers vs those eligible to obtain waivers but did not. At the time the note was posted (late February 2021) the loan-level data needed to perform such a calculation was not available, so we used a sample obtained from the reference loans in the pools used by the Fannie Mae Connecticut Avenue Security (CAS) Credit Risk Transfer (CRT) program.

Earlier this month we obtained the loan level DQ data for the books of the GSEs as of the end of February 2021 so a more comprehensive analysis is now possible. As stated in the comment letter, the eligibility rules to obtain a PIW vary by product type and agency, so to obtain an apples-to-apples comparison we need to look at the performance of loans with waivers against those that are eligible to use them but did not, as opposed to all loans. Since waivers are generally a recent development, we look at performance for loans originated in 2019 and 2020. Recursion in the News: Recursion Provides Comments to FHFA RFI on Appraisal-Waiver Policies3/10/2021

Recursion Co recently provided commentary in response to a Request for Information (RFI) regarding appraisal policies, practices, and processes. We comment on how big data technology can be applied to monitor the performance of loans where appraisals have been waived compared to a benchmark of eligible loans where traditional appraisals have been utilized. In addition, we provide a framework for analyzing how these tools can address issues such as the impact of new processes on fairness and the safety and soundness of the system of mortgage finance from such topics as environmental vulnerability.

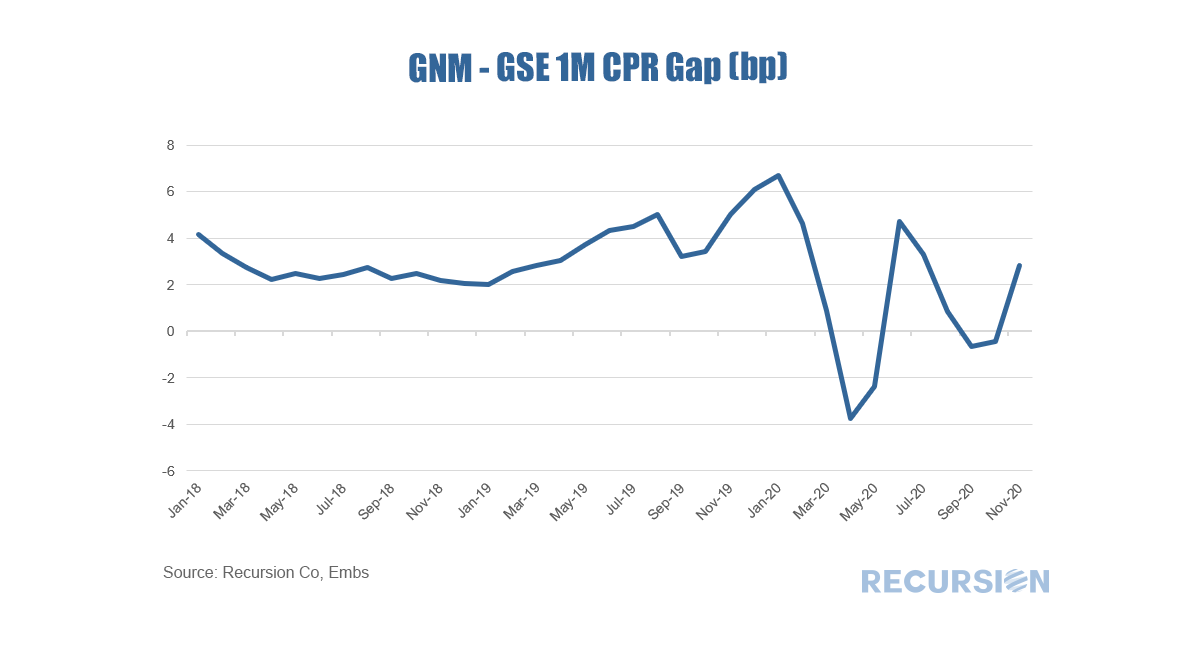

For some time, we have been talking about the key driver of mortgage performance is policy rather than fundamentals. This theme is certainly evident with the release of agency prepayment data for November[1]. The chart below chart displays the gap between the 1M prepayment speeds between Ginnie Mae and GSE securities:

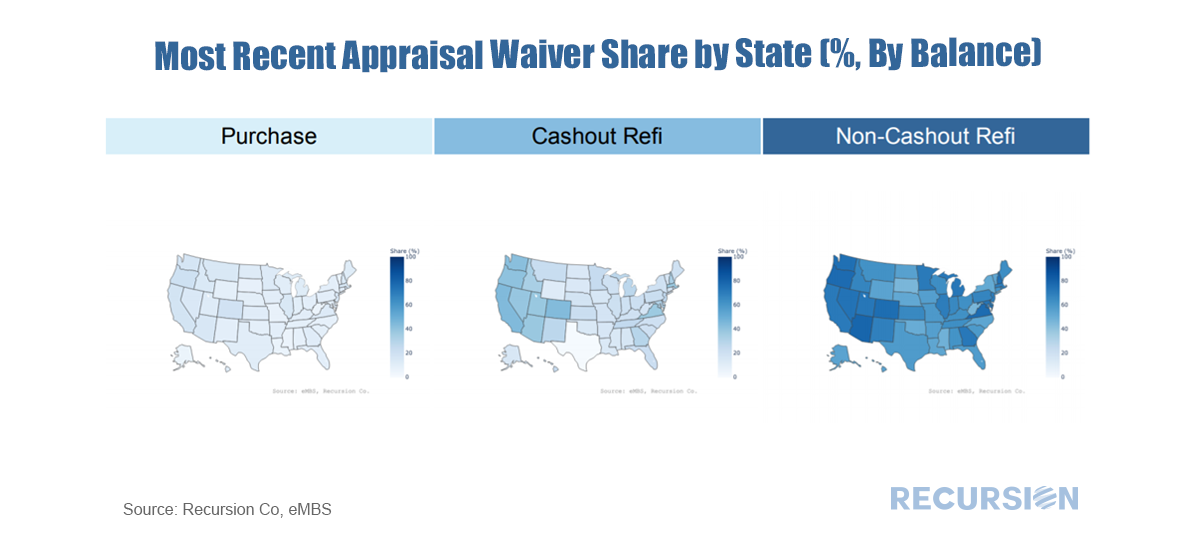

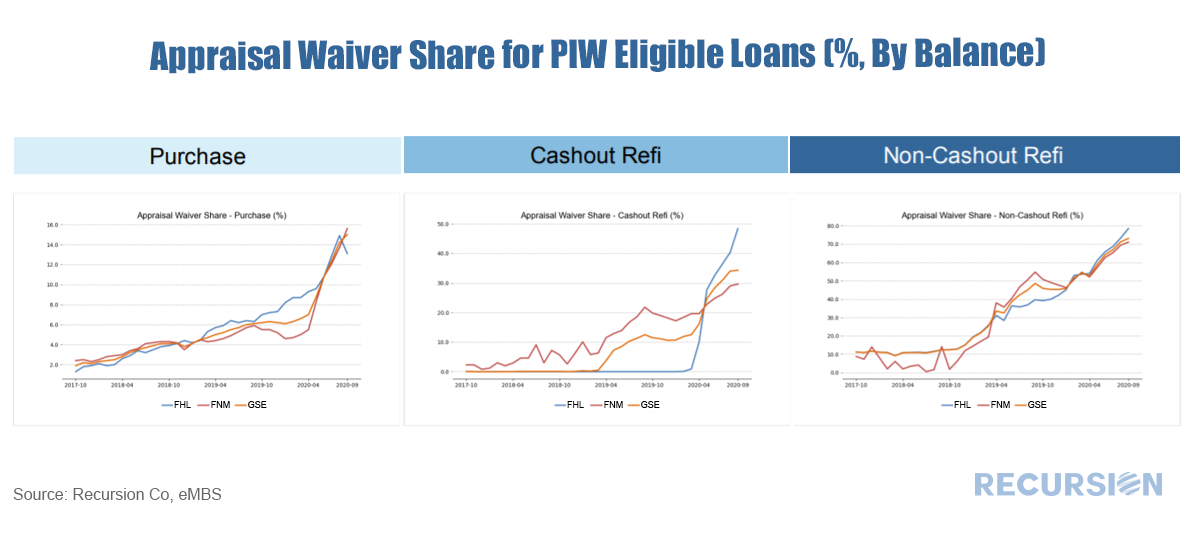

In March 2020, both Fannie Mae and Freddie Mac began to release information regarding “Property Valuation Method” in their loan-level data releases. Based on the availability of this flag, Recursion Co has developed the GSE Property Inspection Waiver Monthly Report to reflect mortgage underwriting trends in this area, beginning in early October. Below are some sample contents of the report. Recursion has programmed the appraisal waiver eligibility guidelines for each GSE into its Cohort Analyzer. The following charts show the shares of PIW loans for each state by loan purpose. For GSE newly issued loans, the West Coast has an overall higher PIW share than the East Coast. The report also provides information about PIW usage. The onset of the Covid-19 pandemic has resulted in an accelerating trend for loans with appraisal waivers across all loan purposes. If you would like to learn more details about Recursion’s GSE Property Inspection Waiver Report, please contact inquiry@recursionco.com.

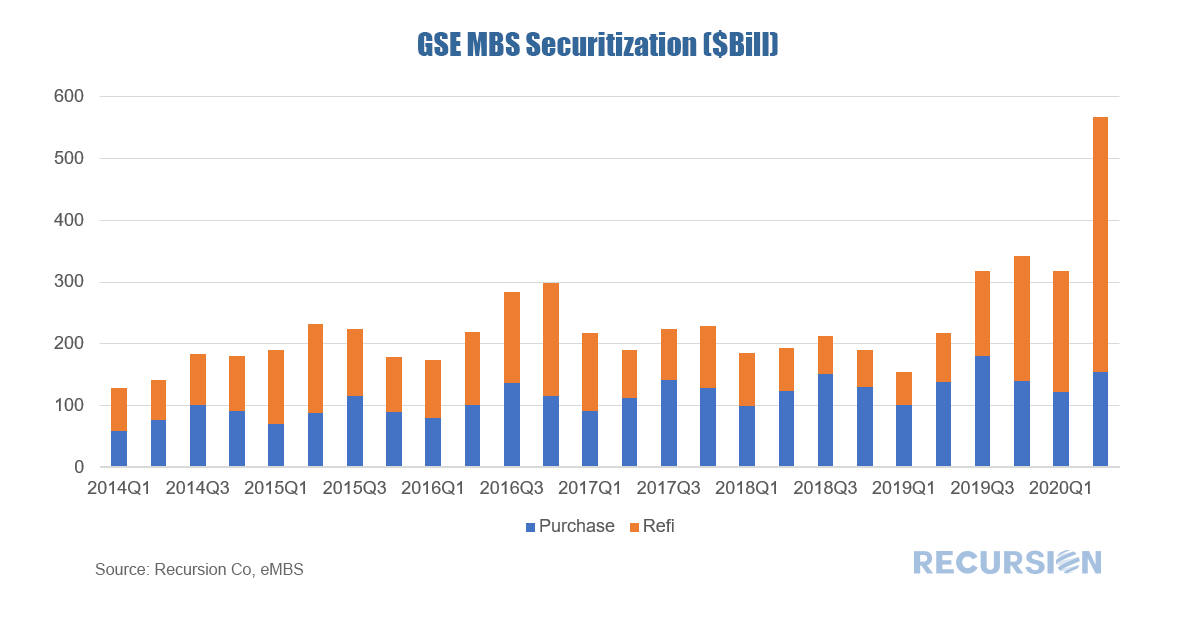

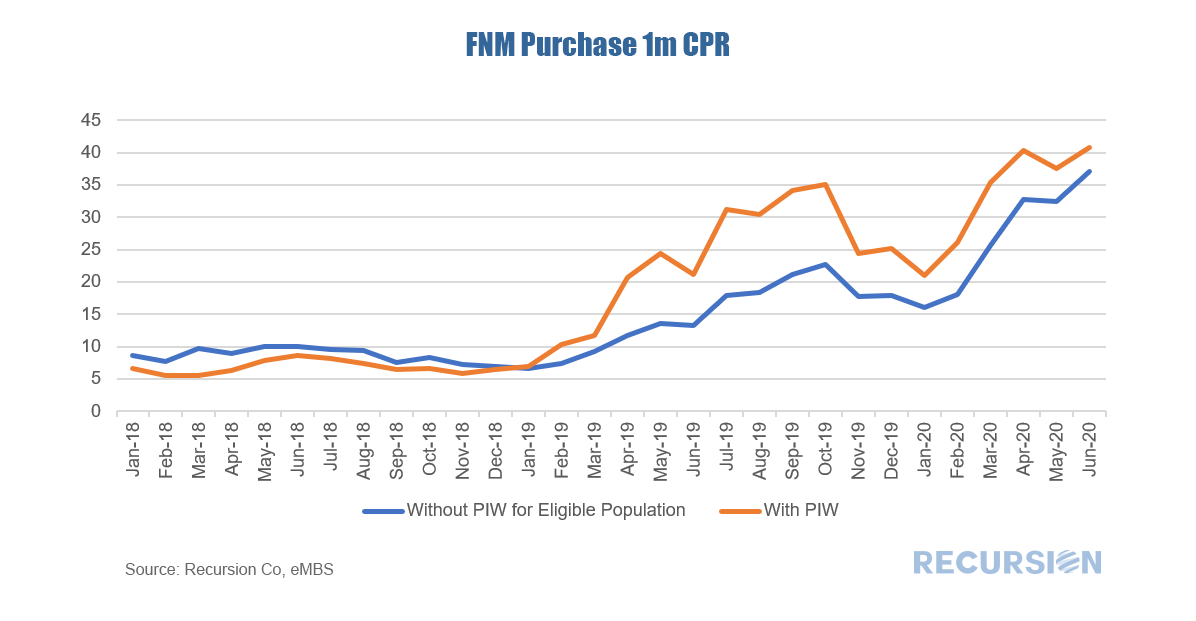

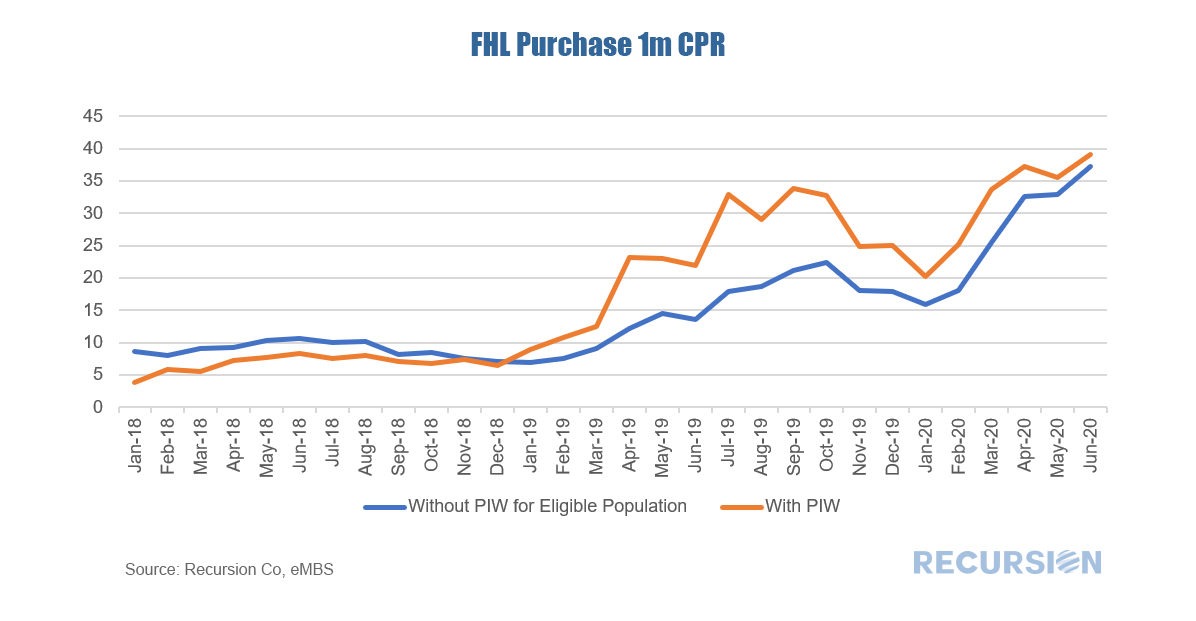

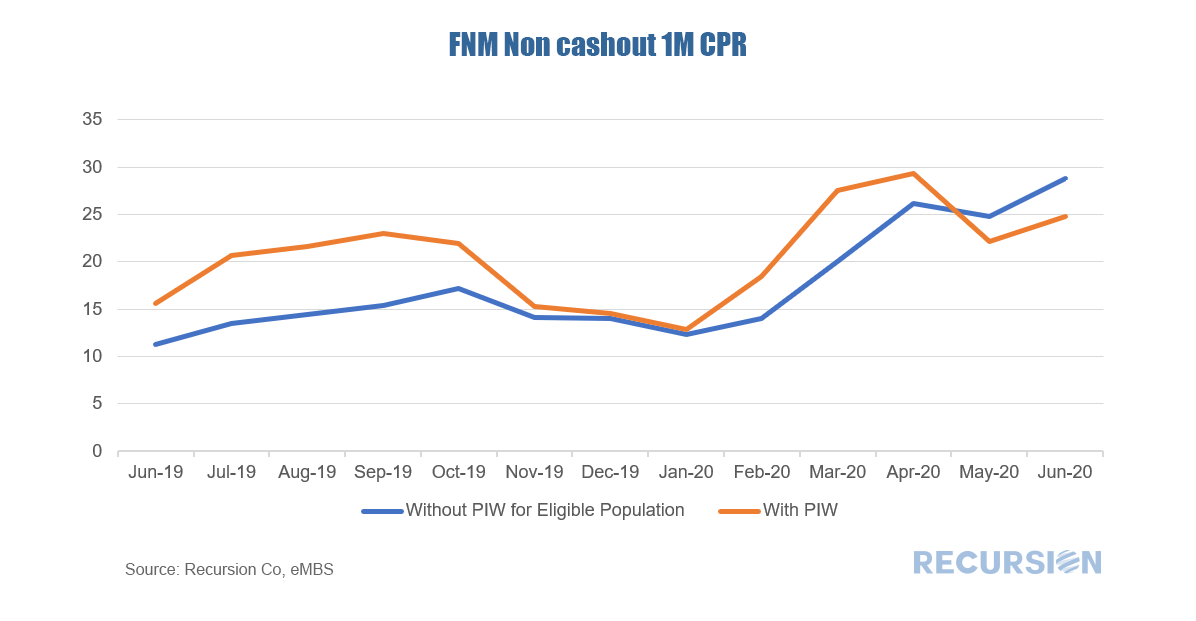

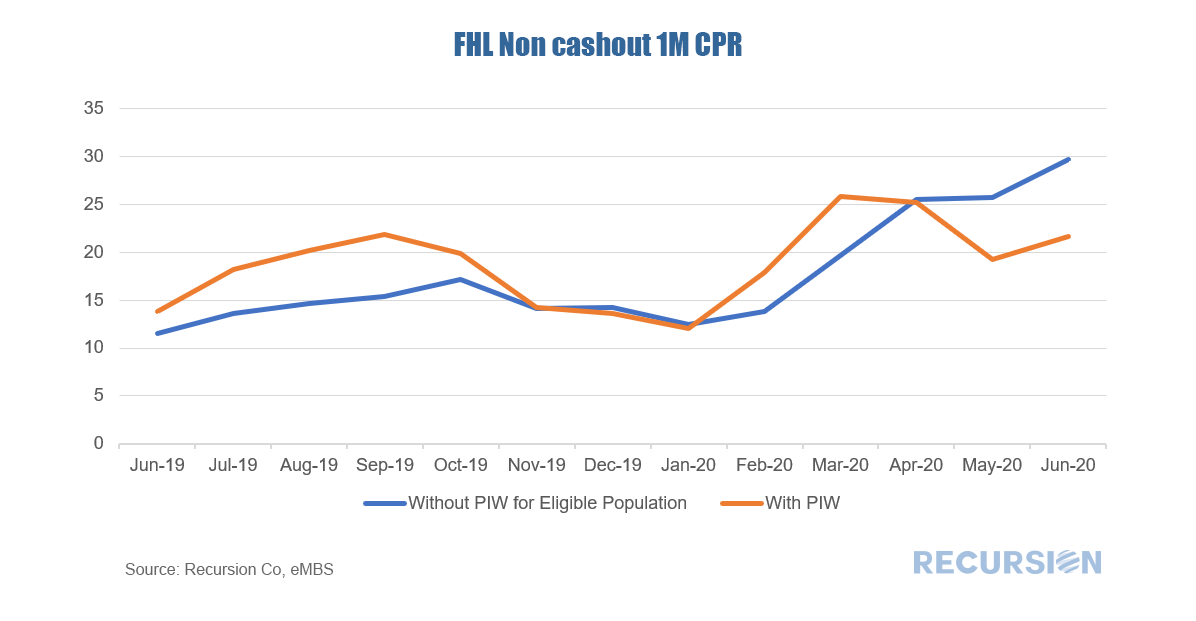

The drop in the 30-yr mortgage rate to close to 3.0% has worked to keep purchase mortgage securitizations relatively steady while refinancing activities have soared to record highs. Refis in Q2 2020 for the GSE’s came in at more than twice the next highest quarterly figure reported over the past seven years: Besides the sharp drop in rates, another factor in this sudden surge compared to previous years is the increasing use of Property Appraisal Waivers. With the transaction costs of refinancing going down as a result, it appears that refis accelerated compared to prior episodes of falling rates. To look at this a bit deeper, below find 1-month prepayment speeds of both PIW loans and PIW eligible purchase loans for the two agencies[1]: For both agencies, it appears that loans with appraisal waivers prepay faster than eligible loans without, but the impact diminishes over time in part because there are fewer such loans with a PIW left that haven’t prepaid. In fact, for non-cashout refis the impact is even more pronounced: In this case not only have prepayment speeds for this category of loans with appraisal waivers slowed relative to others, but in the last couple of months they have actually become slower compared to other eligible loans. A combination of unprecedented policy moves and market developments have served to upend conventional mortgage market analysis, underscoring the need for new thinking, and new tools. [1] For a description of eligibility criteria see https://www.recursionco.com/blog/property-inspection-waiver-eligible-population

Appraisals play an important role in managing the risks associated with residential mortgages. Since 2017, both Fannie Mae and Freddie Mac (GSEs) have published multiple rules (see Appendix below) for lenders to qualify mortgage applications for property inspection waivers (PIW). PIW can reduce the cost of mortgage transactions. However, PIW raised concerns of improper usage among investors, mortgage insurers, regulators and other players in the mortgage market. In particular, research has shown that loans with PIWs prepay much faster than loans without.

In March 2020, both Fannie Mae and Freddie Mac released loan level information regarding “Property Valuation Method” which included the Appraisal Waiver information. The new data regarding PIW’s offers the opportunity to study how this program affects the market. |

Archives

February 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed