|

On September 15, Recursion Data was cited in a story in Commercial Mortgage Alert that pointed out that Fannie Mae “has started to restrict the interest-only payment periods on debt backing properties built before 2000.” They cite Recursion data in pointing out that Fannie Mae purchased $4.2 bn in multifamily loans in August, bringing the year-to-date total to 35.3 billion, down 20% from the same period in 2022.

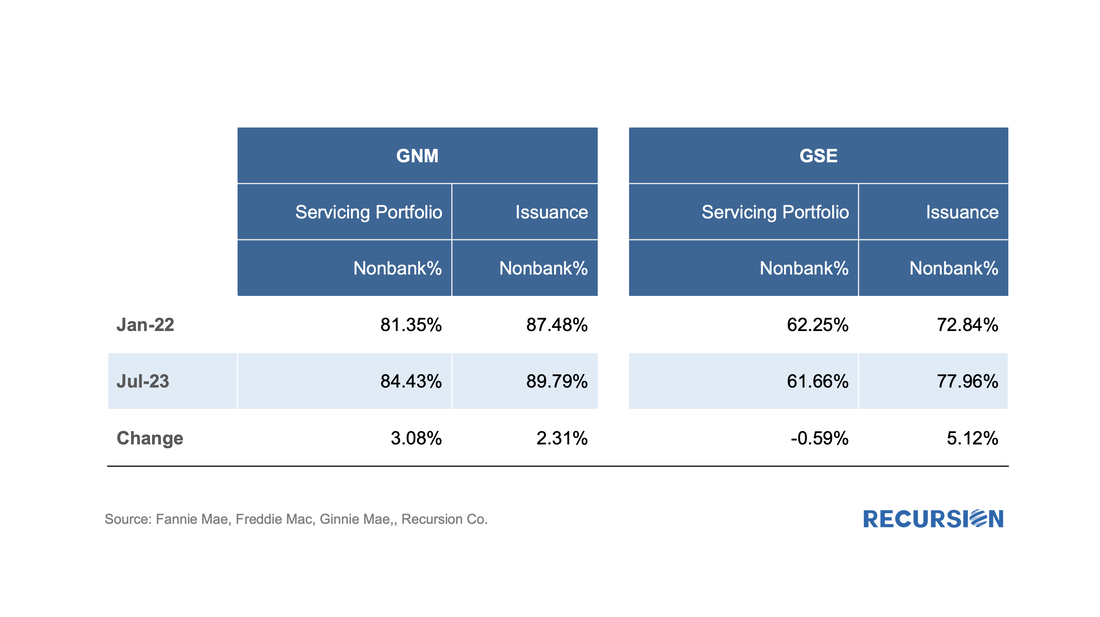

Recursion is pleased to provide excellent support to all participants in this crucial segment of the commercial real estate market. We’ve written many, many times about the inexorable rise in the role of nonbanks in the mortgage market[1]. A variety of factors have contributed to these gains, including superior technology, a relatively less oppressive regulatory environment, and Covid-19 chasing people out of bank branches online.

This picture can be a little blurry, however, depending on the way you look at the market. There is, for example, the distinction between servicing book shares and origination shares. Our agency disclosure data doesn’t provide information on originators, but we can use “seller” as a proxy. The table below looks at the trends in outstanding portfolio and issuance for the conforming and Government markets over the period January 2022 – July 2023: Overview

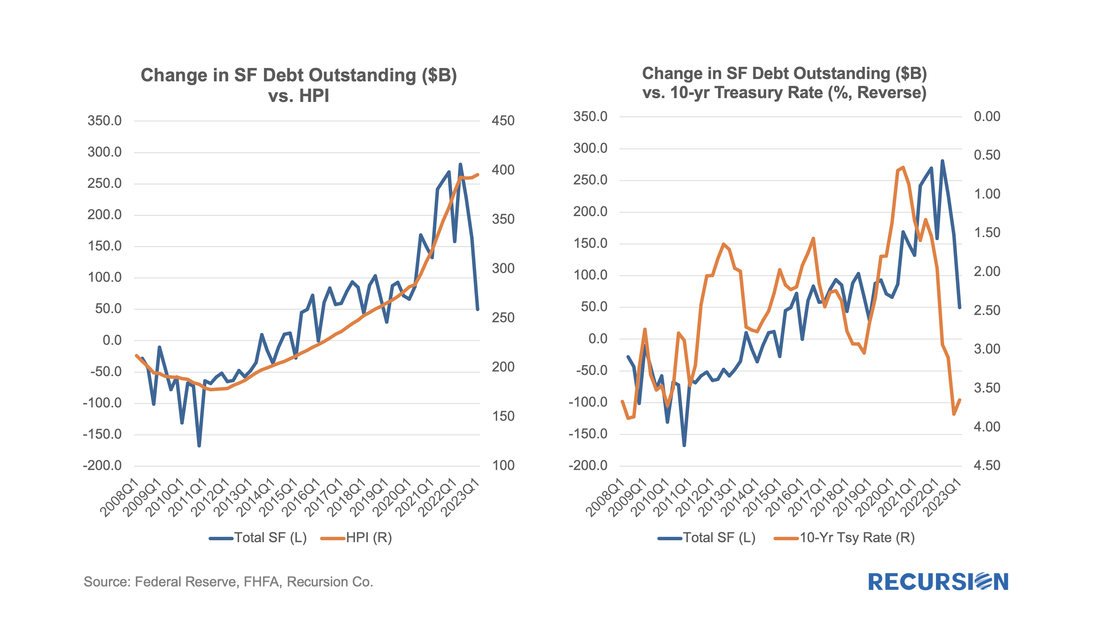

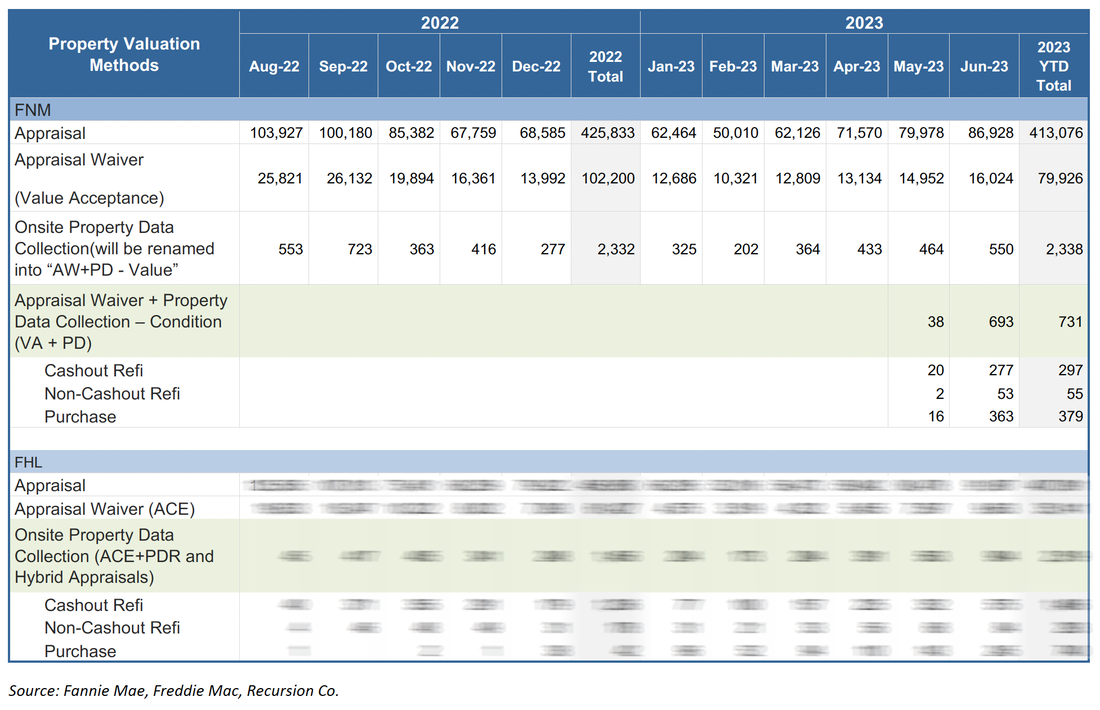

The release of the Financial Accounts of the United States (also known as the Z.1[1]) is always an opportunity to learn about important structural changes in the mortgage market. This is particularly the case in our current environment of high home prices and borrowing costs which we call “mortgage winter”. In this note, we focus on the breakdown on the ownership of risk for single family mortgages. This is not the share of ownership of MBS; it is who bears the credit risk for the loans. Unsurprisingly, the growth in single-family mortgage credit outstanding in Q1 grew by the smallest amount in almost 7 years in the first quarter of 2023: The last time we discussed the topic of appraisal waivers was at the end of 2022, when we looked at the impact of sharply higher interest rates on the use of this flexibility. Property valuation impact profitability of loan origination. Lenders can gain a significant advantage if they fully understand and choose from all the options in front of them. Given recent market developments, it is no doubt time to take another look at this topic, but structural change has come to this space, so it makes sense to discuss this first. Until last year we were in a binary appraisal/waiver world. One or zero. For some time, there have been discussions of various “modernization” programs somewhere in between, with valuations produced via a process that requires less information than that obtained from a full appraisal but not no information. To read the full article, please send an email to inquiry@recursionco.com

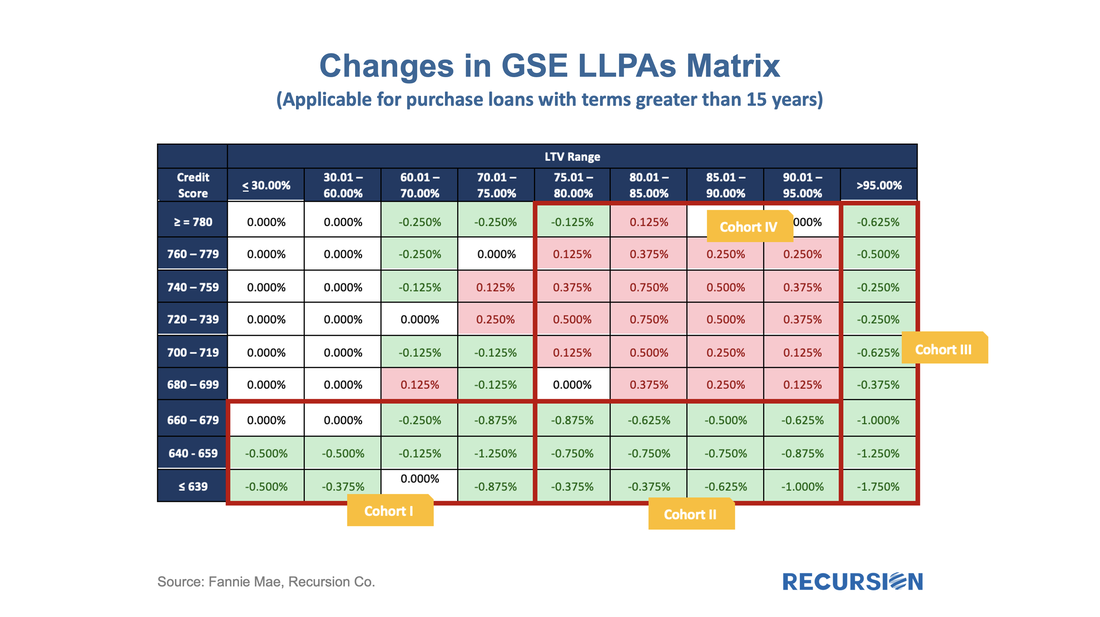

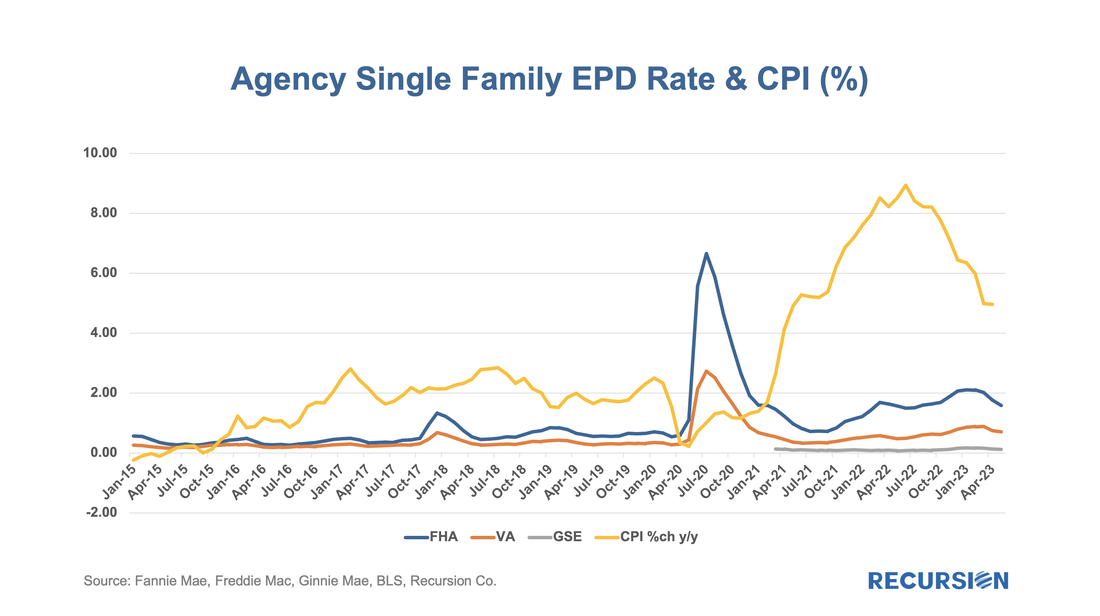

Rising inflation and 30-year mortgage rates near 20-year highs of around 7%, coupled with historically high house prices, have sharply dampened housing demand in the US. This is particularly true for lower-income borrowers where household budgets are badly stretched. These developments have caught the attention of policymakers, who, in response, have taken it upon themselves to lower mortgage fees to partially compensate for these factors. This is an interesting moment in the formation of housing policy as we have two sets of changes taking effect close together in time. First, FHA announced on February 22, 2023, that it would cut its mortgage insurance premiums by 0.30% to 0.55% effective March 20. More recently, on March 22, GSEs implemented a rather complex set of changes in their upfront fee schedules, effective May 1: To read the full article, please send an email to inquiry@recursionco.com

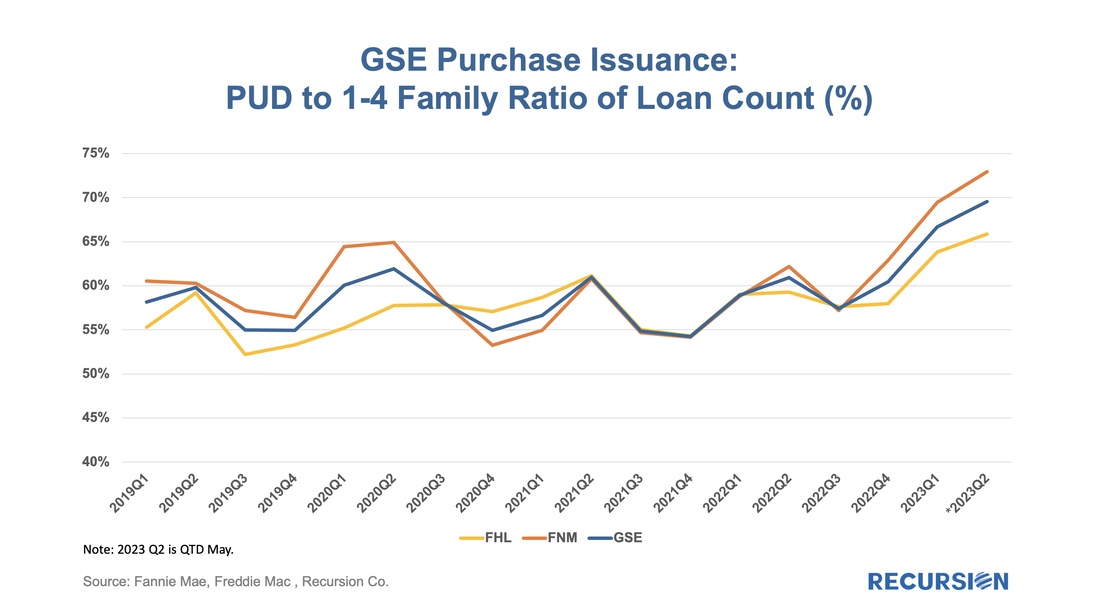

As famous investor Warren Buffett once stated, “Only when the tide goes out do you learn who has been swimming naked.” Well, it turns out that only in a declining market can you see which segments are resilient. In this case, we will look at Planned Unit Developments or PUD’s. A PUD is a planned neighborhood, generally consisting of a group of single-family homes that are bound together by a Homeowners Association (HOA). In this manner, it is like a condo, with the significant difference that the property is usually a stand-alone structure that the buyer owns along with the lot on which it is located. Details about eligibility can be found in Fannie Mae’s selling guide[1].

Below finds the ratio of purchase mortgage deliveries from PUDs to those of 1-4 unit conventional loans: The release of the Agency performance data in early May provided confirmation that the dip in Early Payment Defaults[1] we have witnessed over the last three months ended a 16-month long uptrend in this statistic for FHA loans. A similar but far more muted pattern can be seen for VA and conventional mortgages. In a previous post, we speculated that the uptrend was correlated with the higher inflationary trend observed since early 2021[2]. Below please find an update of the chart:

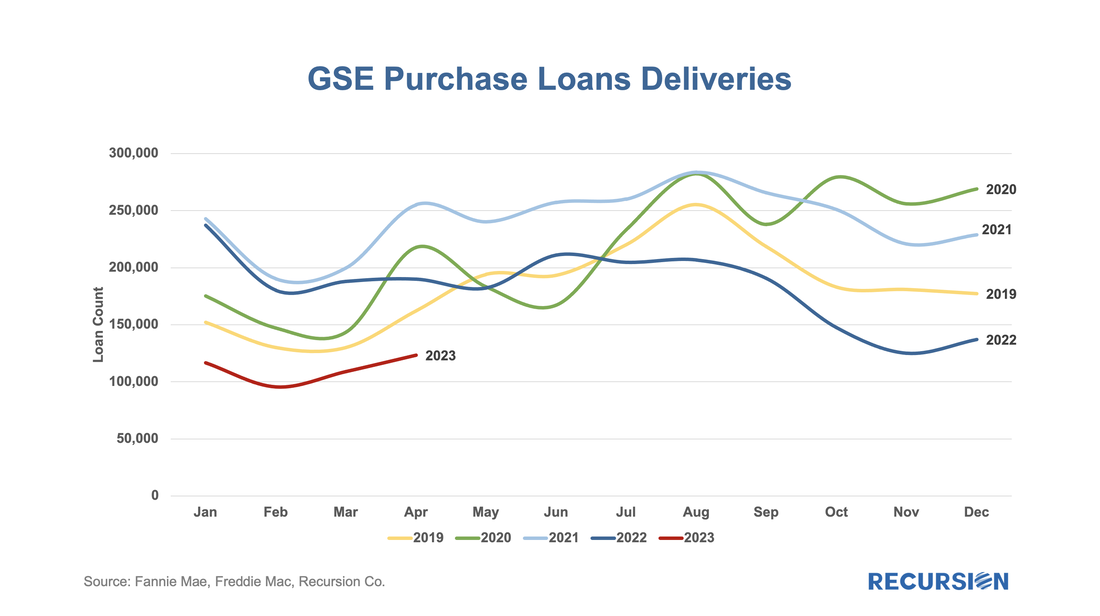

As daily April Agency mortgage loan delivery data completed, we found convincing evidence that the freeze in market activities we have witnessed since the fourth quarter of 2022 is continuing, although there are some new twists.

Here is the chart for the loan counts of purchase market deliveries to the GSEs back to 2019. Rather than do this as a time series, we stack the years over an annual monthly x-axis to better correct for the seasonality in the time series: |

Archives

February 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed